VA Loan Requirements 2026: Zero Down & Credit Score Rules

For military borrowers, the VA loan remains the most powerful mortgage tool in America. However, the VA loan requirements for 2026 have shifted slightly, specifically regarding “Residual Income” charts and Funding Fees.

If you are an active-duty service member, veteran, or surviving spouse, you likely know the biggest perk: Zero Down Payment. But getting approved requires more than just a military ID. You must navigate specific VA loan requirements regarding your credit history, income stability, and the property’s condition.

This guide breaks down the official VA loan requirements for 2026, including the “Credit Score” myth and the new Funding Fee tables.

The Core VA Loan Requirements for 2026

Unlike conventional loans, the Department of Veterans Affairs does not lend you the money. Instead, they guarantee a portion of the loan for the private lender. This guarantee allows lenders to offer you better terms.

To qualify, you must meet three primary VA loan requirements:

- Service: You must have a valid Certificate of Eligibility (COE).

- Credit: You must be a “satisfactory credit risk” (usually a 620+ score).

- Income: You must meet the “Residual Income” standard for your region.

1. Credit Score: The “Hidden” VA Loan Requirements

One of the most confusing VA loan requirements is the credit score.

Officially, the VA does not set a minimum credit score. You can theoretically get approved with a 500 score.

The Reality (Lender Overlays):

While the VA is flexible, private lenders are not. In 2026, most lenders enforce their own minimums, known as “overlays.”

- Standard Minimum: 620 is the magic number for most banks.

- Bad Credit Options: Some specialized lenders will go down to 580, but they are rare.

If your score is below 620, you might want to compare this program with FHA Loan Requirements 2026, which often accepts scores as low as 580 with a 3.5% down payment.

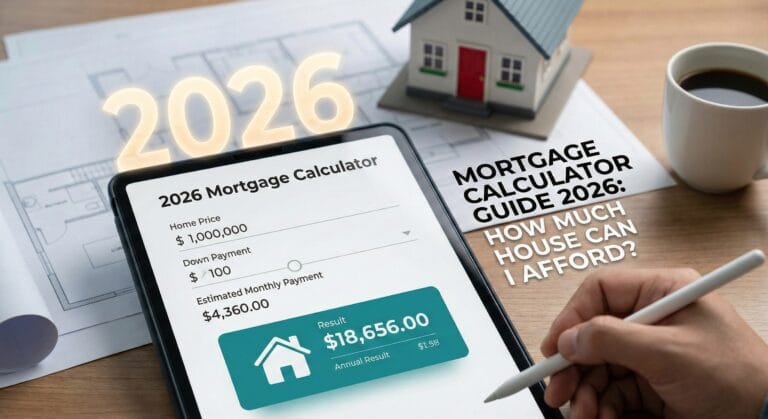

2. VA Loan Limits 2026: Do They Exist?

For years, VA loan requirements included strict limits on how much you could borrow. In 2026, the rule is simple:

If you have your full entitlement, there is NO maximum loan limit.

You can buy a $2 million home with $0 down if you can afford the monthly payments.

The Exception (Partial Entitlement):

If you have a defaulted VA loan or another active VA loan, limits do apply. For 2026, the baseline limit is $832,750 in most counties, rising to $1,249,125 in high-cost areas like D.C. or San Diego.

3. The 2026 VA Funding Fee

While there is no mortgage insurance (PMI), the VA loan requirements mandate a one-time “Funding Fee.” This fee helps keep the program running.

The fee amount depends on your down payment and whether this is your first time using the benefit.

2026 Funding Fee Chart (Purchase)

| Scenario | Down Payment | Fee (First Use) | Fee (Subsequent Use) |

| Zero Down | 0% | 2.15% | 3.3% |

| Small Down | 5% – 9.9% | 1.5% | 1.5% |

| Large Down | 10% + | 1.25% | 1.25% |

How to Waive the Fee:

The best part of the VA loan requirements is the exemption rule. You pay $0 in funding fees if:

- You receive compensation for a service-connected disability (even 10%).

- You are a Purple Heart recipient.

- You are a surviving spouse of a veteran who died in service.

4. Residual Income: The Secret Formula

Most mortgages look at your Debt-to-Income (DTI) ratio. VA loan requirements go a step further. They calculate “Residual Income”—the cash you have left over for food and gas after paying your mortgage and major debts.

The VA has specific charts for 2026 based on your region and family size.

Example: Family of 4

- Northeast: Needs $1,025 left over.

- Midwest: Needs $1,003 left over.

- South: Needs $1,003 left over.

- West: Needs $1,117 left over.

If your new mortgage leaves you with less than this amount, you will fail the VA loan requirements even if your credit score is perfect.

5. Property Conditions (The “MPRs”)

The final hurdle in the VA loan requirements is the appraisal. VA appraisers are strict about the “Minimum Property Requirements” (MPRs).

The home must be “Safe, Sound, and Sanitary.”

Common Deal Breakers in 2026:

- Peeling Paint: Like FHA loans, any home built before 1978 cannot have peeling paint (lead risk).

- Roof Life: The roof must have at least 3-5 years of life remaining.

- Heating: The home must have a permanent heat source (space heaters don’t count).

Summary: Are You Ready to Apply?

Meeting the VA loan requirements in 2026 opens the door to the best mortgage in the country. No down payment and no monthly PMI can save you hundreds of dollars every month compared to a Conventional loan.

Your Checklist:

- Check your COE: Log in to VA.gov to verify your entitlement.

- Calculate Residual Income: Ensure your budget leaves enough “leftover” cash.

- Check for Disability: If you have a rating, ensure your lender knows so they waive the Funding Fee.

If you don’t meet the credit benchmarks, don’t give up. Check our guide on Home Buyer Grants 2026 to see if state-level programs can help you bridge the gap.