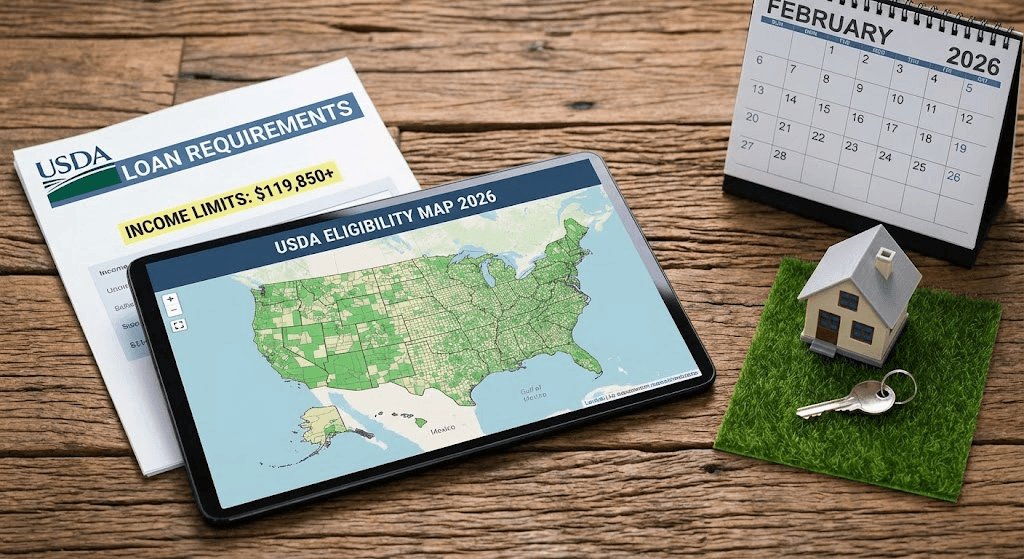

USDA Loan Requirements 2026: Income Limits & Map

When most buyers think of “Zero Down” mortgages, they assume they need a military ID. But in 2026, the USDA loan requirements offer a powerful alternative for civilians that is often overlooked.

If you are willing to live outside a major city center, the USDA Rural Development loan might be the best deal in the housing market. It offers 100% financing, lower interest rates than conventional loans, and cheaper mortgage insurance than FHA.

However, qualifying is tricky. The USDA loan requirements are strict about where you buy and how much you earn. In 2026, the income limits have increased significantly, opening the door for thousands of middle-class families.

This guide breaks down the official USDA loan requirements for 2026, including the new $119,850 income cap, the property eligibility map, and the credit scores you need to get approved.

What Are the USDA Loan Requirements in 2026?

The USDA loan (officially the Section 502 Guaranteed Loan) is backed by the U.S. Department of Agriculture. It is designed to boost homeownership in rural areas.

To qualify, you must meet three primary USDA loan requirements:

- Location: The home must be in an “eligible rural area.”

- Income: Your household income cannot exceed 115% of the area median.

- Credit: You generally need a score of 640+ for automated approval.

Unlike FHA loans, which are for anyone, USDA loan requirements are “means-tested.” This means if you make too much money, you are legally barred from using this program.

1. Income Limits and USDA Loan Requirements

The most critical change in the USDA loan requirements for 2026 is the income cap adjustment. These limits are updated annually to keep up with inflation.

Standard Income Limits (Most Counties):

- 1–4 Member Household: $119,850.

- 5–8 Member Household: $158,250.

High-Cost Areas: In expensive regions like California or the Northeast, the limits are much higher. For example, in parts of Santa Cruz, CA, a family of four can earn up to $265,100 and still qualify.

Important Calculation Rule: The USDA loan requirements look at household income, not just the borrower’s income. Even if your spouse isn’t on the loan, their income counts toward the limit. However, you can deduct childcare expenses ($480 per child) to help you stay under the cap.

2. Property Eligibility: The “Rural” Myth

Many buyers assume “rural” means a farm with cows. In reality, the USDA loan requirements define “rural” quite loosely.

The Rule: Generally, any town with a population under 35,000 is eligible. This means many suburbs just 20 minutes outside of Austin, Orlando, or Nashville currently meet the USDA loan requirements.

How to Check: You can verify a specific address instantly on the Official USDA Eligibility Map. If the property is in a “shaded” area, it is ineligible. If it is in the “white” area, it qualifies.

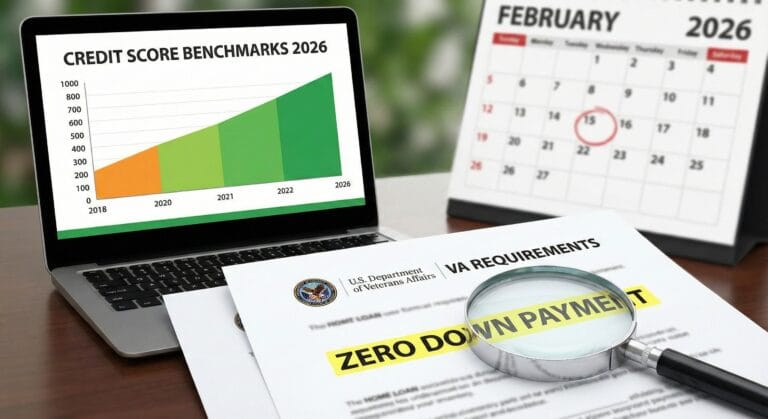

3. Credit Score USDA Loan Requirements

While the official USDA guidelines don’t set a hard minimum credit score, lenders do.

- 640+ Score: This is the “Magic Number.” If you have a 640, you can use the GUS (Guaranteed Underwriting System) for an automated approval.

- 600–639 Score: You face “Manual Underwriting.” This is much harder and requires a lower Debt-to-Income (DTI) ratio.

Debt-to-Income (DTI) Ratio: The standard USDA loan requirements for DTI are 29/41.

- 29%: Your new mortgage payment shouldn’t exceed 29% of your gross income.

- 41%: Your total debts (mortgage + cars + cards) shouldn’t exceed 41%.

If your credit is below 600, you will likely struggle to meet these strict USDA loan requirements. In that case, you might be better suited for FHA Loan Requirements 2026, which allows higher debt loads and lower scores.

4. The “Hidden” Costs: Guarantee Fees

Although there is no down payment, USDA loan requirements mandate two specific fees to keep the program solvent.

Upfront Guarantee Fee (1%): You pay 1% of the loan amount at closing.

- Example: On a $300,000 home, the fee is **$3,000**.

- Good News: You can roll this $3,000 into the loan amount, so you don’t pay it out of pocket.

Annual Fee (0.35%): This acts like monthly mortgage insurance (PMI).

- Rate: 0.35% of the loan balance annually.

- Comparison: FHA charges 0.55%, and Conventional PMI can be 1%+. This makes USDA the cheapest mortgage insurance option available.

Summary: Meeting USDA Loan Requirements

Meeting the USDA loan requirements in 2026 is the smartest financial move a first-time buyer can make. You get the zero-down benefit of a VA loan without needing military service.

Your Checklist:

- Check the Map: Ensure the home is in an eligible zone.

- Check Your Income: Verify your total household earnings are under $119,850 (or your local limit).

- Check Your Score: Aim for a 640 to breeze through underwriting.

If you make too much money for USDA but still need help with a down payment, check our guide on Home Buyer Grants 2026 for state-level programs that don’t have location restrictions.