Student Loan Tax Bomb 2026: Is Forgiveness Taxable Again?

For the last five years, millions of borrowers avoided the student loan tax bomb thanks to a temporary waiver from Congress. Between 2021 and 2025, if your federal student loans were forgiven, the IRS treated it as tax-free money.

That safety net officially expired on December 31, 2025.

Now, in 2026, we have returned to the pre-pandemic tax code. This marks the resurrection of the student loan tax bomb—a financial shock where the IRS treats your canceled debt as “taxable income.”

If you are pursuing IDR forgiveness or a private settlement this year, you must prepare. You could trade a monthly loan payment for a sudden IRS tax bill. This guide explains how the student loan tax bomb works in 2026, which states are the most dangerous, and the one legal loophole—”Insolvency”—that can save you.

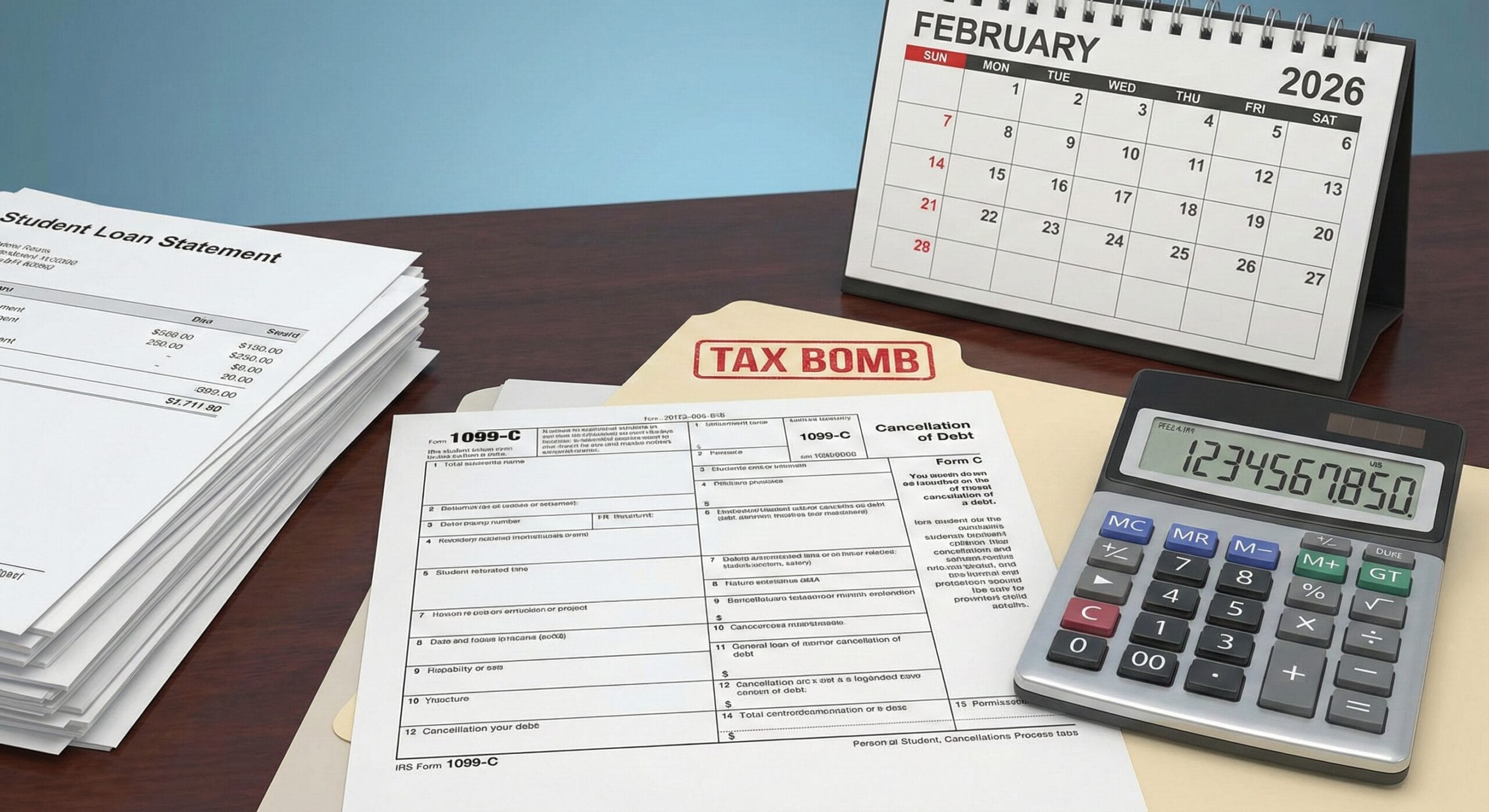

What Is the Student Loan Tax Bomb?

To the IRS, debt forgiveness is the same as earning a paycheck. If you borrowed $50,000 and didn’t pay it back, the tax code views that $50,000 as wealth you accumulated.

When a lender cancels your debt, they are required by law to send you Form 1099-C (Cancellation of Debt). They also send a copy to the IRS.

The Math of the Bomb: Imagine you earn $60,000 a year and have $40,000 in student loans forgiven in 2026.

- Old Taxable Income: $60,000.

- New Taxable Income: $100,000.

- The Consequence: You are pushed into a higher tax bracket. You might suddenly owe the IRS an extra $8,000 to $10,000 in federal taxes, due immediately when you file your return.

For many borrowers, this student loan tax bomb is devastating because they don’t have $10,000 in cash lying around.

Exceptions: Avoiding the Student Loan Tax Bomb

Not every forgiveness program triggers the student loan tax bomb. Even with the 2021 waiver gone, specific federal programs remain permanently tax-free under statutory law:

- PSLF (Public Service Loan Forgiveness): Totally safe. Section 108(f) of the tax code specifically exempts PSLF from taxation.

- Death & Disability (TPD) Discharge: Safe. The Tax Cuts and Jobs Act made this permanently tax-free.

- Borrower Defense to Repayment: Safe. If your school defrauded you, the discharge is not taxable.

Who Is at Risk? The student loan tax bomb is primarily a threat to borrowers on Income-Driven Repayment (IDR) plans (SAVE, IBR, PAYE) who reach the end of their 20 or 25-year repayment term in 2026 or later.

The Settlement Trap

There is a second group of borrowers at risk: those settling private student loans. If you are in default on a private loan and negotiate a settlement (e.g., paying $5,000 to settle a $15,000 debt), the $10,000 difference is considered canceled debt.

- Private Lenders: Will almost always issue a 1099-C.

- The Result: You save money on the loan, but you trigger a mini student loan tax bomb on your next tax return.

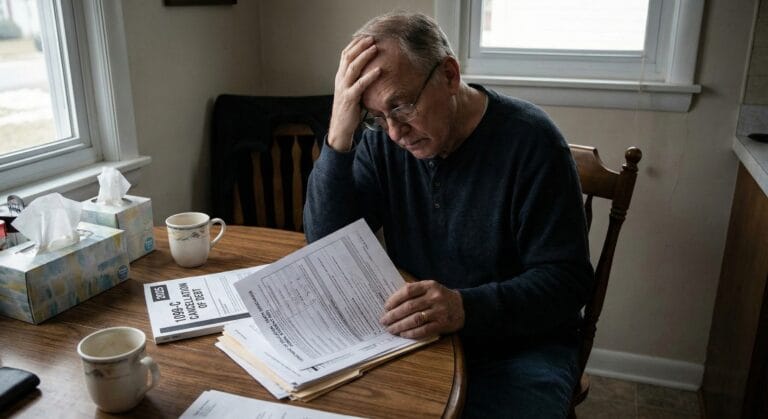

The Loophole: Insolvency and the Student Loan Tax Bomb

If you receive a 1099-C this year, do not panic. You may be able to defuse the student loan tax bomb using IRS Form 982.

This is called the Insolvency Exclusion. The IRS cannot tax you on forgiven debt if you were “insolvent” immediately before the forgiveness happened.

The Insolvency Test: You are insolvent if your Total Liabilities are greater than your Total Assets.

Example Calculation: Let’s say you have $50,000 in student loans forgiven.

- Your Assets: $5,000 (Old car + Bank account).

- Your Debts: $60,000 (The student loans + Credit cards).

- The Math: $60,000 (Debts) – $5,000 (Assets) = **$55,000 Insolvent**.

Because your insolvency amount ($55,000) is greater than the forgiven loan amount ($50,000), the entire student loan tax bomb is defused. You owe $0 in taxes.

For official instructions, always refer to the IRS Form 982 Page.

State Taxes and the Student Loan Tax Bomb

While Form 982 can save you from federal taxes, state taxes are a different animal. Some states do not follow federal tax rules automatically. Historically, states like Mississippi, North Carolina, and Indiana have taxed student loan forgiveness even when the federal government did not.

In 2026, now that the federal waiver is gone, expect nearly all states with an income tax to treat forgiveness as taxable income unless they pass specific exemptions.

Action Item: If you live in a state with income tax, set aside 5% of the forgiven amount in a savings account just in case.

Summary: Prepare for the Bill

The return of the student loan tax bomb in 2026 changes the math for loan forgiveness. It is no longer “free money”—it is a taxable financial event.

Your 2026 Checklist:

- Check Your Plan: If you are on PSLF, relax. You are safe.

- Calculate Net Worth: If you are on IDR, track your assets vs. debts. Being “broke” on paper is your best defense.

- File Form 982: If you get a 1099-C, never file your taxes without exploring the insolvency exclusion first.

If you are unsure if your loans are even eligible for forgiveness yet, review our guide on IDR Account Adjustment 2026 to see exactly where you stand in the repayment count.