Student Loan Tax 2026: Is Forgiveness Taxable?

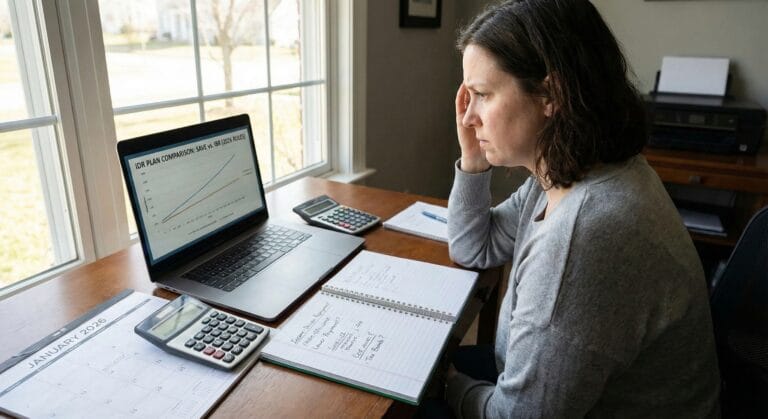

Are you worried about the new student loan tax 2026 rules? For the last five years, millions of borrowers breathed a sigh of relief because the American Rescue Plan made all student loan forgiveness 100% tax-free.

That safety net is gone.

As of January 1, 2026, the federal tax exemption has expired. This means if your student loans are forgiven this year, the IRS may treat the cancelled debt as “taxable income.” This is known as the “Tax Bomb,” and it could leave you with a surprise bill.

However, not every program is taxable.

This guide clarifies exactly which forgiveness programs trigger a student loan tax 2026 bill, how much you might owe, and the “Insolvency” loophole that could save you.

Which Programs Trigger a Student Loan Tax 2026 Bill?

The rules have changed. Use this table to check if your specific program triggers a federal tax bill.

| Forgiveness Program | Federal Tax Status (2026) | Notes |

| Public Service Loan Forgiveness (PSLF) | Tax-Free | PSLF is permanently tax-free under Section 108(f) of the IRS Code. |

| IDR Forgiveness (SAVE, IBR, PAYE) | TAXABLE | If you reach your 20 or 25-year forgiveness milestone in 2026, this is taxable income. |

| Death & Disability (TPD) Discharge | Taxable | Currently taxable again unless Congress passes retroactive legislation. |

| Borrower Defense to Repayment | Tax-Free | Usually considered non-taxable as it corrects a “legal injury” caused by the school. |

| Teacher Loan Forgiveness | Tax-Free | Permanently tax-free ($5k or $17.5k awards). |

Warning: Even if your forgiveness is federally tax-free, some states may still tax it as income. See the list below.

How Much Will the “Tax Bomb” Cost You?

If you are on an Income-Driven Repayment (IDR) plan and receive forgiveness in 2026, the forgiven amount is added to your gross income for the year.

Example Scenario:

- Your Salary: $50,000

- Forgiven Debt: $40,000

- New “Taxable Income”: $90,000

This doesn’t just increase your taxes; it might bump you into a higher tax bracket.

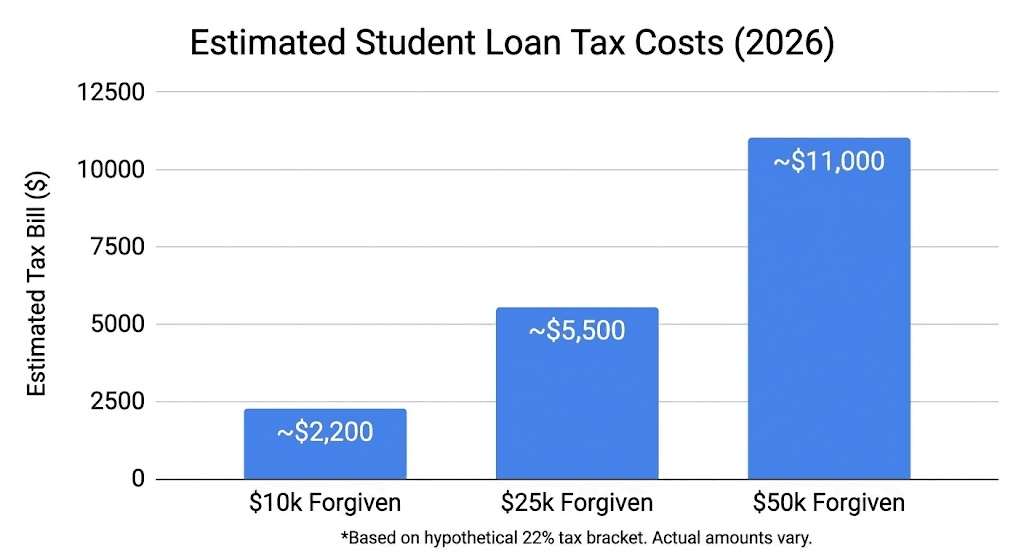

Estimated Tax Bill (2026 Rates)

If you are in the 22% tax bracket, here is roughly what you would owe on the forgiven amount:

- **$10,000 forgiven** = ~$2,200 IRS Bill

- **$25,000 forgiven** = ~$5,500 IRS Bill

- **$50,000 forgiven** = ~$11,000 IRS Bill

State Taxes: The “Hidden” Cost

Even if you avoid the federal student loan tax 2026, you might still owe state income tax depending on where you live.

As of February 2026, the following states generally treat student loan forgiveness as taxable income unless specific legislation is passed:

- Indiana (Taxable)

- Mississippi (Taxable)

- North Carolina (Taxable)

- Wisconsin (Taxable)

- Arkansas (Taxable)

[Insert Image Here: Alt Text = map of states with student loan tax 2026]

Note: If you live in one of these states, set aside roughly 5% of the forgiven amount for your state tax bill.

The “Insolvency” Loophole: How to Avoid Paying

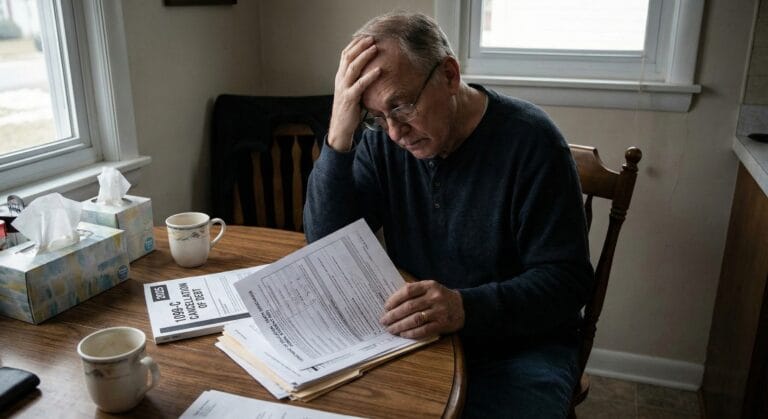

If you receive a Form 1099-C (Cancellation of Debt) in the mail, do not panic. The IRS offers an exception called “Insolvency” (Form 982).

The Rule: If your total debts are higher than your total assets at the exact moment your loan is forgiven, you do not have to pay tax on the difference. You can verify this rule directly on the official IRS Form 982 page.

What counts as “Debts”?

- Student loans

- Credit card debt

- Mortgages

- Car loans

- Medical bills

What counts as “Assets”?

- Cash/Savings

- Home equity

- Value of your car

- Retirement accounts (401k/IRA)

The Math:

If you have $100,000 in total debt (including the student loan) and only $30,000 in assets, you are “insolvent” by $70,000. Since your insolvency is greater than the forgiven loan, you likely won’t pay a dime in taxes.

Summary: What To Do Next

- Check your program: If you are pursuing PSLF or Teacher Loan Forgiveness, you are safe from federal taxes.

- Prepare for IDR: If you are on an IDR plan (SAVE/IBR) and nearing year 20 or 25, start saving for a potential student loan tax 2026 bill now.

- Consult a Pro: Tax laws change rapidly. Before filing your 2026 return, speak to a CPA about filing Form 982 if you think you qualify for the insolvency exclusion.