Student Loan Death Discharge 2026: Rules for Parents & Spouses

In the tragic event of a borrower’s death, federal student loans are not passed on to the family—they are cancelled. This process is officially known as student loan death discharge. However, the rules for Parent PLUS loans and spousal responsibility can be confusing. This guide clarifies who is responsible for the debt and warns of the new 2026 tax implications.

For a broader look at all forgiveness options, check our Student Loan Forgiveness 2026 Ultimate Guide.

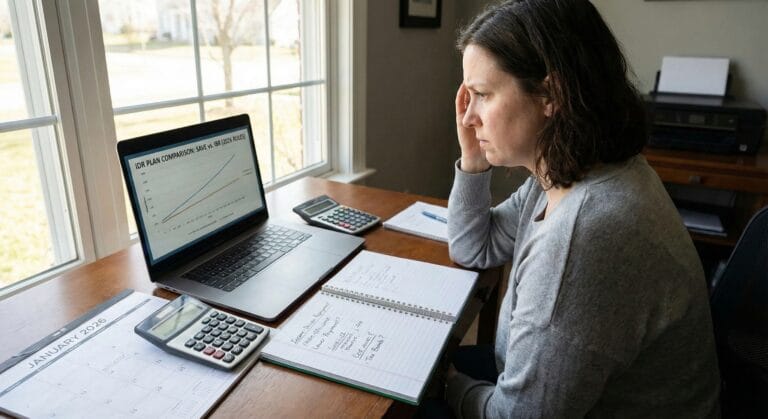

Rules for Student Loan Death Discharge by Loan Type

- Direct Loans (Student): If the student borrower dies, the loans are 100% discharged. The family is not responsible for paying them.

- Parent PLUS Loans: This is the most misunderstood rule. The loan is discharged if EITHER:

- The Parent (borrower) dies, OR

- The Student (for whom the money was borrowed) dies.

- Note: If both parents are on the loan (Endorser), the surviving endorser might still be liable.

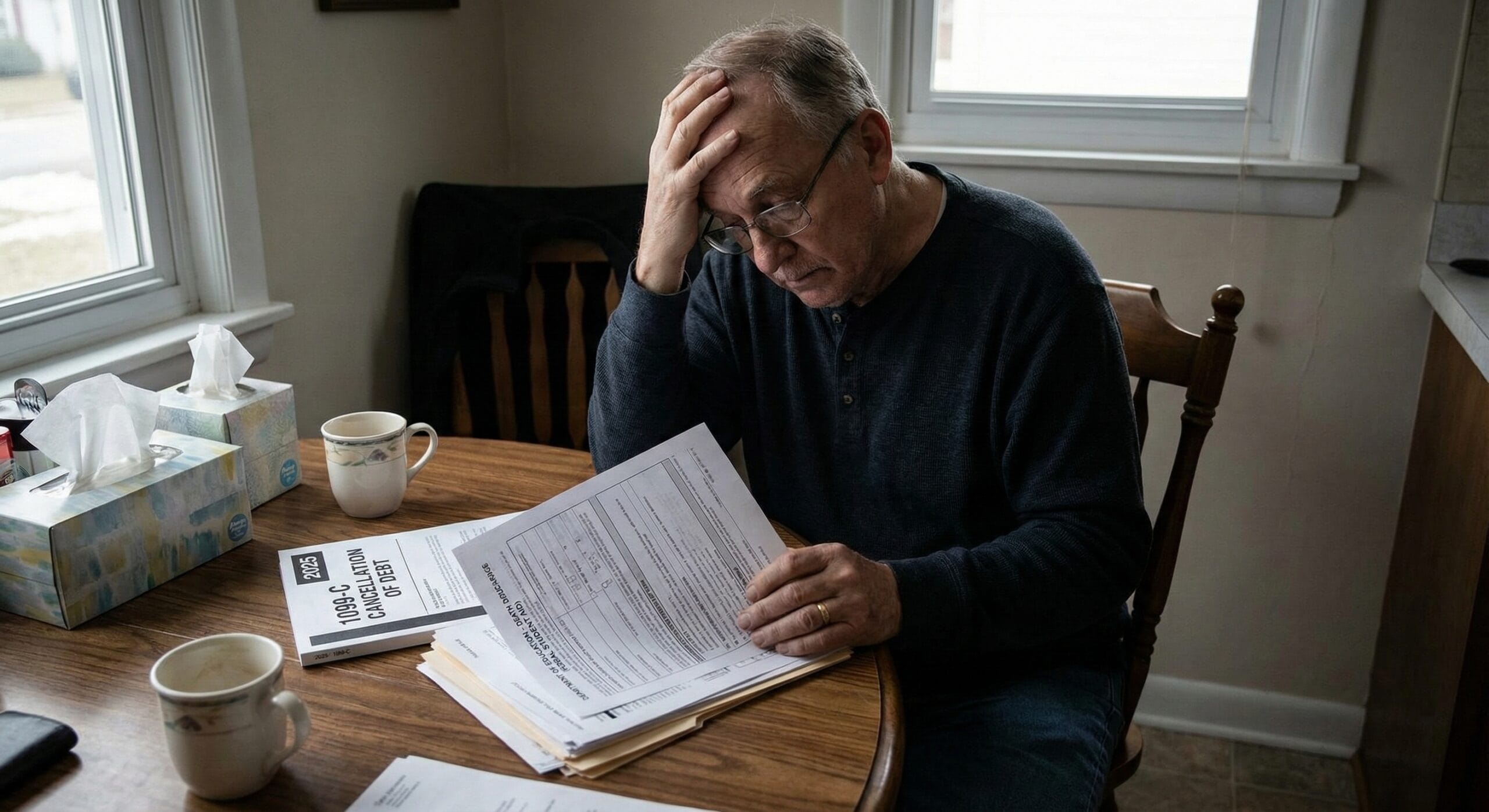

The “Tax Bomb” Warning (2026 Update)

This is a critical financial warning for families in 2026.

- 2018–2025: Under the Tax Cuts and Jobs Act, student loan death discharges were federally tax-free.

- 2026 Status: That specific tax provision expired on December 31, 2025. Unless Congress renews it, the IRS may treat the cancelled debt as taxable income for the estate.

- Advice: If you receive a Form 1099-C for the deceased, consult a tax professional immediately. You can review the official tax rules in IRS Publication 970 (Tax Benefits for Education) to see if you qualify for an “Insolvency” exception. Properly filing for student loan death discharge can save the estate thousands in potential taxes.

Private Loans (The Risk)

Private loans do not always follow federal rules.

- Cosigners: If a student dies and there is a cosigner (like a parent or grandparent) on a private loan, the lender may require the cosigner to pay it back.

- Compassionate Review: Some private lenders (like Sallie Mae or SoFi) have policies to forgive the debt upon death, but it is not guaranteed by law. You must ask for a “Compassionate Review.”

How to Apply for Student Loan Death Discharge

- Obtain the Death Certificate: You will need an original or certified copy of the death certificate.

- Contact the Servicer: Call the loan servicer (e.g., MOHELA, Nelnet). You can find the official rules and contact details on the Federal Student Aid Death Discharge page.

- Submit Proof: Mail or upload the certificate to the servicer.

- Stop Payments: Payments should stop immediately. Any payments made after the date of death will be refunded to the estate.

Frequently Asked Questions

- “Will this hurt the surviving spouse’s credit?” No. The loan is removed from credit reports.

- “What about joint consolidation loans?” If one spouse dies, the portion of the loan attributed to them is discharged, but the survivor remains responsible for their own portion.