Nurse Corps Loan Repayment 2026: The Full Guide

Nursing school is expensive, but the US government is desperate for more nurses. If you are willing to work in a high-need area, the nurse corps loan repayment benefit could pay off the majority of your debt in just two years. This guide explains the 2026 application rules, the “Critical Shortage Facility” requirement, and how to apply. For a full list of other options, check our Student Loan Forgiveness 2026 Ultimate Guide.

How Much Debt Does Nurse Corps Loan Repayment Cover?

Unlike other programs that offer a fixed flat amount, this program is percentage-based.

- 60% Payoff: If you commit to a 2-year service contract, the program pays off 60% of your total outstanding nursing education debt.

- +25% Bonus: If you extend your contract for an optional 3rd year, they pay off an additional 25% of your original balance.

- Total Benefit: You can have up to 85% of your student loans paid off in just 3 years.

Who Is Eligible?

To qualify for nurse corps loan repayment in 2026, you must meet these three criteria:

- License: You must be a licensed Registered Nurse (RN), Advanced Practice Registered Nurse (APRN), or Nurse Faculty member.

- Education: You must have a nursing degree from an accredited US school.

- Employment: You must work full-time (at least 32 hours/week) at a Critical Shortage Facility (CSF).

What is a “Critical Shortage Facility”?

You cannot just work at any hospital. Your workplace must be in a designated “Health Professional Shortage Area” (HPSA). Common examples include:

- Disproportionate Share Hospitals (DSH).

- Public Hospitals.

- Federally Qualified Health Centers (FQHC).

- Rural Health Clinics.

- Tip: You can check your facility’s status using the HRSA Data Warehouse.

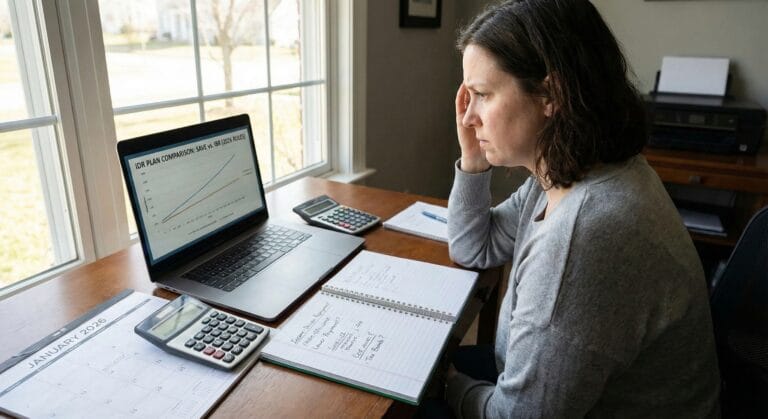

Nurse Corps vs. PSLF: The “Tax Trap”

This is the most important section for your wallet.

- PSLF: Takes 10 years. Pays 100% of the balance. Tax-Free. (See our PSLF Guide for details).

- Nurse Corps: Takes only 2-3 years. Pays 85% of the balance. Fully Taxable.

- Warning: The money paid for your loans by the Nurse Corps is considered “gross income” by the IRS. You will owe federal income taxes on it. However, the program often withholds taxes for you to help reduce the burden.

How to Apply

The application window is not open all year. It typically opens once a year (often in Winter/Spring).

- Create Account: Go to the BHW Customer Service Portal.

- Prepare Documents: You will need your transcripts, loan verification letters, and proof of US citizenship.

- Wait for Cycle: If the application is closed, sign up for email alerts so you don’t miss the 2026 window.

Frequently Asked Questions

- “Can I do both PSLF and Nurse Corps?” Technically yes, but you cannot count the same service period for both. You have to finish one contract before counting time for the other.

- “Does it cover private loans?” Yes! Unlike PSLF, the Nurse Corps program can pay off private student loans if they were used for nursing education.

- “What if I quit early?” Do not do this. If you break your contract, you must pay back the money with heavy interest penalties.