Military Student Loan Forgiveness 2026: The Full Guide

Serving in the US military grants you access to some of the most powerful military student loan forgiveness benefits in the country. From having your interest rate capped at 0% while deployed to getting up to $65,000 of your debt paid off, these benefits go far beyond standard options. This guide covers the 2026 rules for the Army, Navy, Air Force, and National Guard.

For a broader look at all forgiveness options, check our Student Loan Forgiveness 2026 Ultimate Guide.

CLRP vs. Military Student Loan Forgiveness

This is often the most lucrative option, but it is not forgiveness—it is a recruitment incentive. If you enlist (or re-enlist) in a specific branch, the military may pay your loan servicer directly.

- Army & Navy: Can pay up to $65,000 of your qualifying student loans. Typically, they pay 33.3% of your principal balance per year of service.

- National Guard: Can pay up to $50,000 for eligible soldiers who enlist for a 6-year term.

- Air Force: Historically focuses on the JAG Corps (lawyers), paying up to $65,000, though programs change based on recruitment needs.

- Critical Warning: You generally must have this written into your enlistment contract before you join. If it is not in your paperwork, you likely won’t get it.

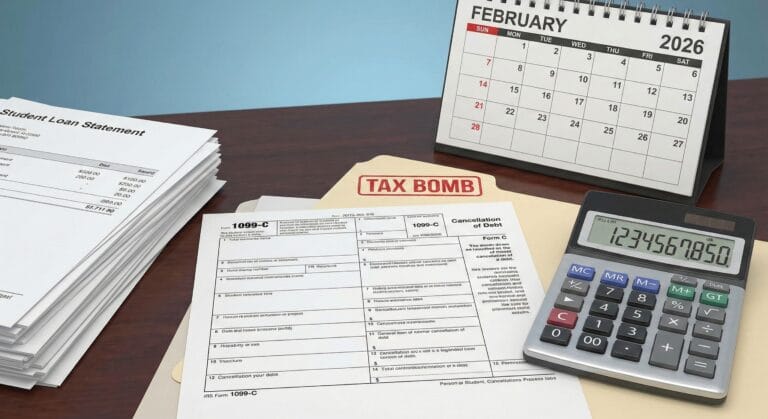

- Tax Note: Unlike PSLF, these payments are often considered taxable income.

The “0% Interest” & SCRA Benefits

You should never pay full interest while on active duty. There are two separate laws that protect you:

1. SCRA Interest Cap (6%) Under the Servicemembers Civil Relief Act, interest on any student loans you took out before joining the military is capped at 6%.

- Scope: This applies to both federal and private student loans.

- How to get it: Send your military orders to your loan servicer.

2. Hostile Fire Pay (0% Interest) If you are serving in a designated “hostile fire” or “imminent danger” pay area, you pay 0% interest on your Direct Loans for up to 60 months.

- The Benefit: The government waives all interest during this time.

- Automation: This is supposed to be automatic via DoD data matching, but errors happen. Always check your statements.

Military Student Loan Forgiveness via PSLF

Military service counts as “Public Service” for the PSLF Program. This is the best option for career soldiers or officers with large balances.

- Automatic Credit: The Department of Education now matches data with the Department of Defense. You should see your military service months count toward PSLF automatically.

- Deferment Counts: Even if you paused payments while on active duty, those months still count toward your 120 required payments.

- Learn More: Read our full Public Service Loan Forgiveness (PSLF) Guide to understand how to certify your employment.

Veterans: Total Disability (TPD)

If you have a service-connected disability, you likely do not need to apply for forgiveness—it comes to you automatically.

- The Rule: If the VA gives you a 100% disability rating (or deems you “individually unemployable”), your student loans are discharged automatically.

- Timeline: Nelnet (the TPD servicer) receives data from the VA quarterly and sends you a letter notifying you of the discharge.

- Tax Warning: Be sure to check our Total & Permanent Disability (TPD) Guide for important details about potential taxes on this discharge in 2026.

Perkins Loan Cancellation (Hostile Fire)

If you have an older Perkins Loan, you have a unique “hidden” benefit.

- The Rule: If you serve in a hostile fire/imminent danger area, you can get up to 100% of your Perkins Loan cancelled (usually 50% cancelled for each year of service).

- Learn More: Check our Perkins Loan Cancellation Guide for the specific forms needed.

How to Apply for Military Student Loan Forgiveness

- For SCRA/0% Interest: Send a copy of your military orders to your loan servicer. You can verify your benefits on the official Federal Student Aid Military page.

- For CLRP: Talk to your Recruiter or Personnel Officer. This is a contract benefit, not a Dept of Education benefit.

- For PSLF: Use the official PSLF Help Tool to certify your service dates if they are missing from the automatic match.

Choosing the right military student loan forgiveness program depends on your rank, your branch of service, and whether you are Active Duty or a Veteran.

Frequently Asked Questions

- “Does the GI Bill pay off loans?” Generally, no. The GI Bill pays for new education. It usually cannot be used to pay off old loans (though some exceptions exist).

- “Can I consolidate?” Yes, but be careful. Consolidating might erase your progress toward CLRP benefits. Check with your chain of command first.

- “What about Spouses?” Military spouses often qualify for PSLF if they work in government/non-profit jobs, and they have special protections under SCRA for joint consolidation loans.