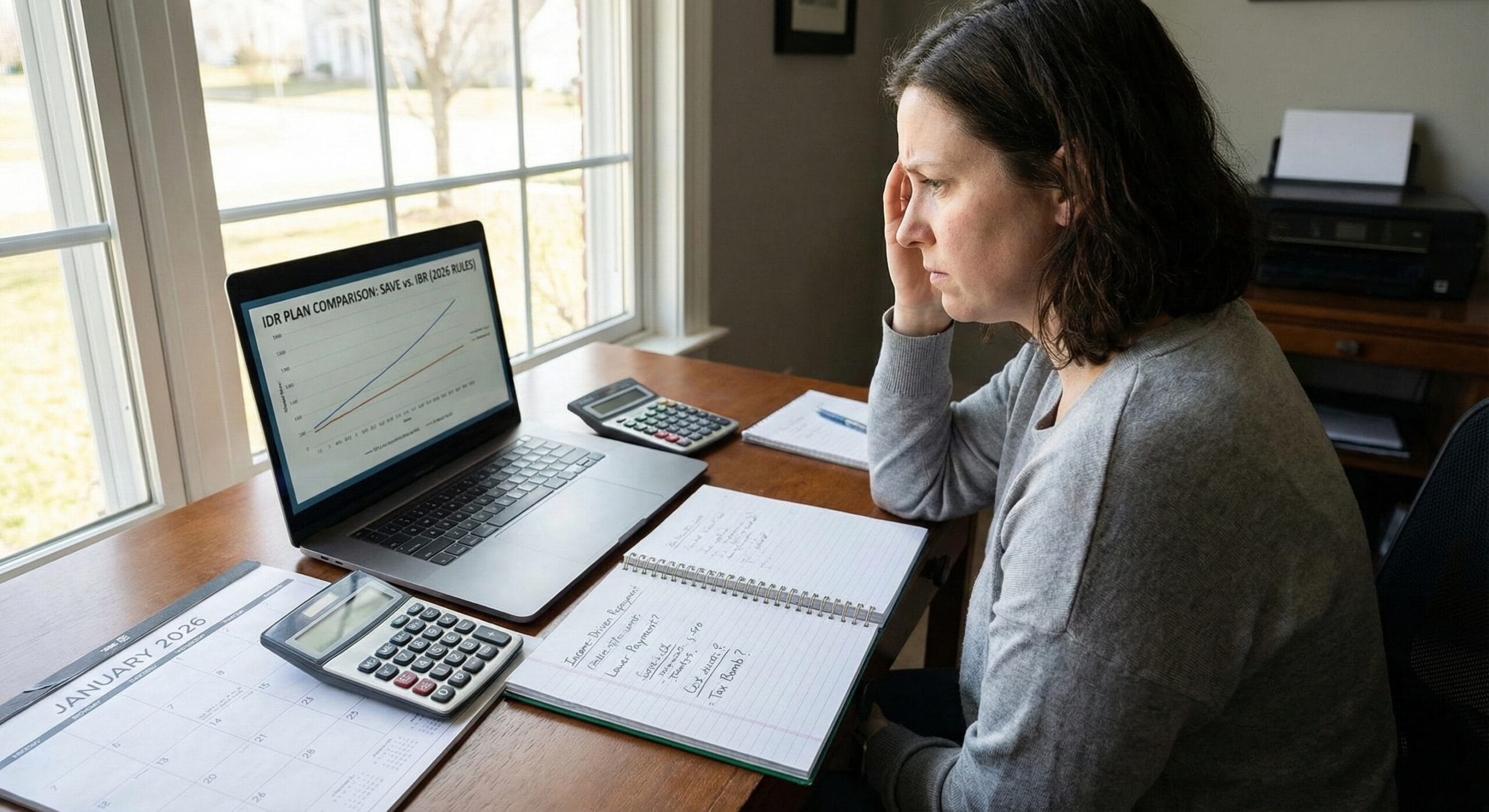

Income-Driven Repayment (IDR) Plans 2026: SAVE, IBR, & New Rules

If you cannot afford your standard student loan payment, you are not alone. Income-Driven Repayment (IDR) plans are designed to cap your monthly bill at a percentage of your income—sometimes as low as $0. However, 2026 has brought significant changes, including legal challenges to the popular SAVE Plan and new eligibility rules for the IBR Plan. This guide explains which plan is safe for you right now. For a broader look at forgiveness, check our Student Loan Forgiveness 2026 Ultimate Guide.

The Current Status of the SAVE Plan

- The Situation: As of 2026, the SAVE Plan (formerly REPAYE) is currently facing significant legal hurdles. Many borrowers enrolled in SAVE have been placed in an administrative forbearance.

- The Advice: If you are currently on SAVE and your payments are paused, watch your email closely. You may be required to switch to a different plan (like IBR) to continue getting credit toward forgiveness.

- New Applicants: It is generally recommended to apply for IBR or PAYE until the legal status of SAVE is fully resolved.

The “Safe Haven”: Income-Based Repayment (IBR)

With SAVE in limbo, the Income-Based Repayment (IBR) plan has become the most stable option for 2026.

- New Rule: Previously, you needed a “Partial Financial Hardship” to join IBR. Recent updates have relaxed this, making it easier for more borrowers to enroll.

- The Cap: IBR caps your payments at 10% or 15% of your discretionary income (depending on when you borrowed).

- Forgiveness: After 20 or 25 years of payments, any remaining balance is forgiven.

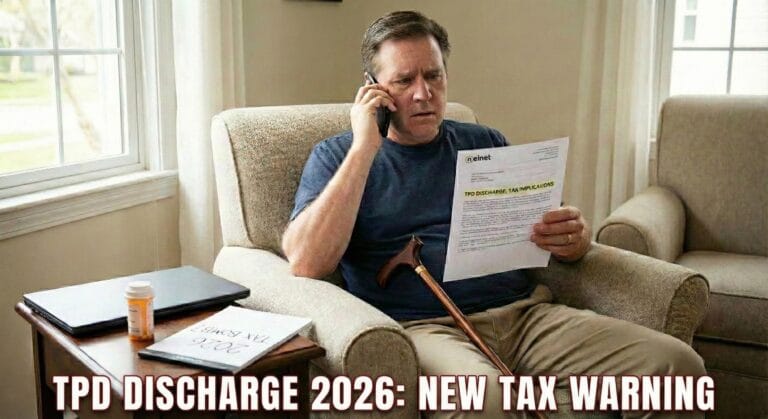

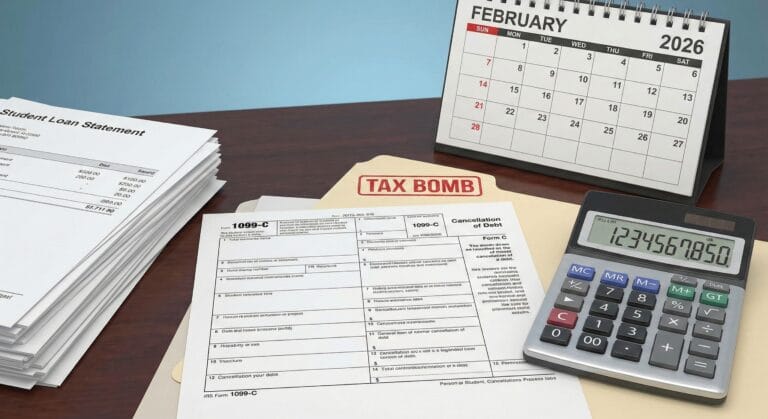

IDR Forgiveness & The “Tax Bomb”

This is a critical update for 2026.

- 2021-2025: Under the American Rescue Plan, all student loan forgiveness was tax-free.

- 2026 Status: Unless Congress extends the law, forgiveness granted in 2026 and beyond may be treated as taxable income by the IRS.

- What to Do: If you are close to forgiveness (20-25 years), start saving a small “tax fund” just in case you receive a 1099-C tax form for the forgiven amount.

How to Apply for an IDR Plan

- Log In: Go to the official IDR Application Page on StudentAid.gov.

- Select “Lowest Payment”: Instead of picking a specific plan, you can check the box that says “Place me on the plan with the lowest monthly payment.” This allows the loan servicer to pick the best valid option (usually IBR or PAYE) for you.

- Recertify: Remember, you must recertify your income every year. If you forget, your payment will jump back to the high “Standard” amount.

Frequently Asked Questions

- “Did the IDR Account Adjustment finish?” Yes. The “one-time adjustment” that fixed payment counts ended in late 2025. You should now see your updated count on your dashboard.

- “Can I switch from IBR to SAVE later?” Yes. If the courts fully clear the SAVE plan, you can switch to it later to get lower payments.

- “Do I have to pay if I’m unemployed?” No. If you have $0 income, your IDR payment will be $0/month, and it still counts toward the 20-year forgiveness goal.