Robinhood (HOOD stock) has become one of the most talked-about stocks in 2025. With a 226% surge year-to-date, HOOD stock has significantly outperformed the S&P 500, capturing the attention of investors worldwide. But after such a rapid rise, many are asking: can HOOD stock continue its upward momentum, or is a pullback likely before the next breakout?

This article explores Robinhood’s latest financial results, user growth, product innovations, global expansion, valuation, and investment risks, providing tips, strategies, and real-life examples for investors.

Robinhood’s Q2 Financial Highlights

Robinhood reported net revenue of $989 million, a 45% increase year-over-year, surpassing analyst expectations by more than $75 million. This growth was broad-based, reflecting strong performance across transaction, options, cryptocurrency, and equities revenue.

Revenue breakdown:

- Transaction-based revenue: $539 million, up 65% YoY

- Options revenue: $265 million, up 46% YoY

- Cryptocurrency revenue: $160 million, up 98% YoY

- Equities revenue: $66 million, up 65% YoY

- Net interest revenue: $357 million, up 25% YoY

Profitability metrics were equally strong. Net income reached $386 million, up 105% year-over-year, while diluted earnings per share doubled to $0.42. Adjusted EBITDA grew 82% to $549 million, with a 56% margin. These results show that HOOD stock is not just growing, but also delivering significant profits.

User Growth and Product Innovation

Robinhood’s expansion is fueled by a growing user base and innovative products. Funded customers increased to 26.5 million, including roughly 520,000 from the Bitstamp acquisition, giving Robinhood a global presence.

The Robinhood Gold subscription service has 3.5 million subscribers, up 76% year-over-year. Key offerings include:

- Gold Card with over 300,000 cardholders

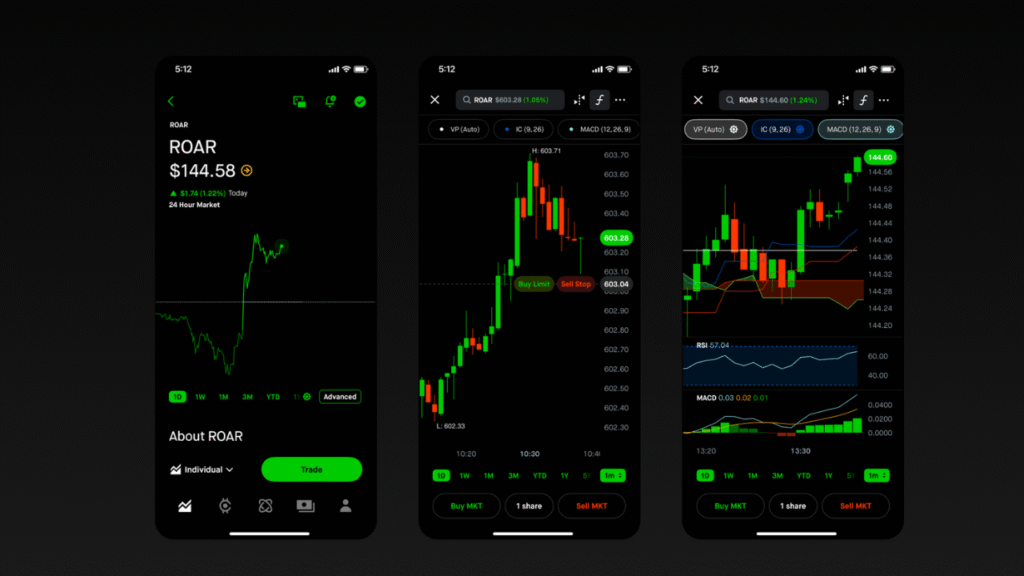

- Cortex AI investment tool for smarter trading

- Robinhood Banking, launching soon, to consolidate customer finances

These initiatives show how Robinhood is evolving from a trading app into a comprehensive financial ecosystem.

Real-life example: An active trader uses Robinhood Gold for instant deposits, relies on Cortex AI for investment guidance, and trades crypto 24/7. This seamless experience keeps users engaged and loyal.

Global Expansion and Crypto Initiatives

Robinhood is expanding internationally. The Bitstamp acquisition added institutional services, over 50 licenses, and 600,000 international users.

Robinhood has also launched stock tokens in 30 European countries, enabling 24/7 trading with self-custody options. Additionally, the company is developing Robinhood Chain, a Layer 2 blockchain for real-world assets, positioning itself as a leader in tokenization and global financial innovation.

Investor tip: Monitor Robinhood Chain adoption and tokenized assets. These developments could drive long-term revenue and enhance HOOD stock’s growth potential.

Valuation Concerns and Potential Pullback

Despite strong fundamentals, HOOD stock appears overvalued compared to peers like Interactive Brokers (IBKR) and Charles Schwab (SCHW).

Comparative metrics:

- Market cap: HOOD $108B | IBKR $112B | SCHW $173B

- Net interest margin: HOOD 34% | IBKR 57% | SCHW 48%

- Operating margin: HOOD 42.6% | IBKR 72.5% | SCHW 43.5%

- Forward P/E 2025: HOOD 72x | IBKR 33x | SCHW 15x

These numbers indicate that HOOD stock may experience a short-term retracement before resuming its upward trend.

Strategy for investors:

- Take partial profits after large gains

- Watch support levels around $100

- Track competitor actions and market trends

Risks and Opportunities

Risks:

- HOOD stock could face selling pressure due to high valuation

- Execution delays in new products could slow growth

- Competitors may introduce features to retain or win customers

- Broader market volatility may impact stock performance

Opportunities:

- Expansion into banking and tokenization can boost revenue

- Growing Gen Z and millennial user base

- Increased engagement through Robinhood Gold and AI tools

Tips for Investing in HOOD Stock

- Diversify investments to mitigate volatility

- Use stop-losses to protect gains during a pullback

- Monitor earnings reports for market-moving insights

- Follow product launches for potential catalysts

- Track international adoption to gauge global growth

FAQs About HOOD Stock

Q1: What is driving HOOD stock’s surge in 2025?

A1: Strong Q2 revenue growth, rising funded accounts, Robinhood Gold expansion, and crypto initiatives are driving HOOD stock higher.

Q2: Is a pullback expected for HOOD stock?

A2: Yes, analysts expect a retracement due to stretched valuation and high P/E multiples.

Q3: How does HOOD compare to competitors?

A3: HOOD is growing faster but trades at higher valuation multiples than IBKR and SCHW, indicating higher short-term risk.

Q4: What are long-term opportunities for HOOD stock?

A4: Banking services, Cortex AI, Robinhood Chain, and international expansion are key growth areas.

Q5: Should investors buy HOOD stock now?

A5: Investors should approach HOOD with a long-term strategy, considering potential pullbacks and monitoring product and global expansion developments.

Conclusion

HOOD stock has delivered a remarkable 226% surge in 2025, transforming retail investing for millions. While the company’s fundamentals, user growth, and innovative products remain strong, its valuation suggests a short-term pullback is likely. Investors should focus on Robinhood Gold, banking services, crypto initiatives, and global expansion as long-term growth drivers. Careful timing, strategy, and risk management are essential for navigating HOOD stock in the current market environment.