Homeowners Insurance Cost 2026: Rates & Guide

Owning a home is the American Dream, but managing the rising Homeowners Insurance Cost 2026 trends is becoming a major challenge for household budgets. If you have opened your renewal notice recently and felt a shock, you are not alone.

Across the U.S., premiums have risen significantly this year. Whether you are a first-time buyer closing on a house or a long-time owner looking to cut costs, understanding why the homeowners insurance cost 2026 averages are up—and what you can do about it—is critical for your financial health.

In this guide, we break down the cost trends, explain the factors driving prices up, and provide five actionable strategies to lower your bill.

5 Ways to Lower Your Homeowners Insurance Cost 2026

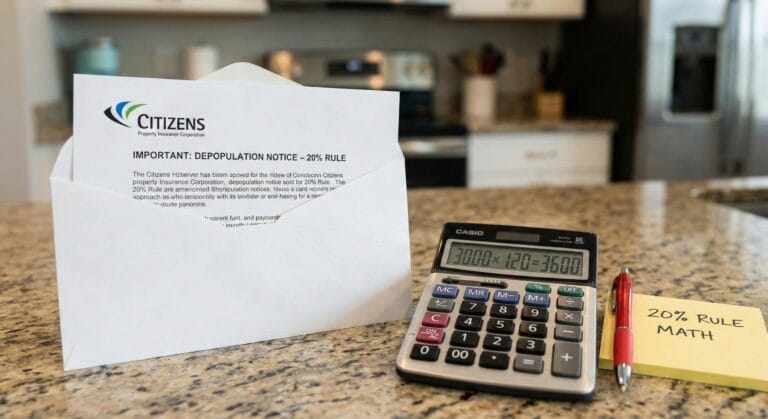

It is not just you—rates are up nearly everywhere. Insurance carriers are facing a “perfect storm” of economic and environmental factors that are forcing them to raise premiums to stay solvent.

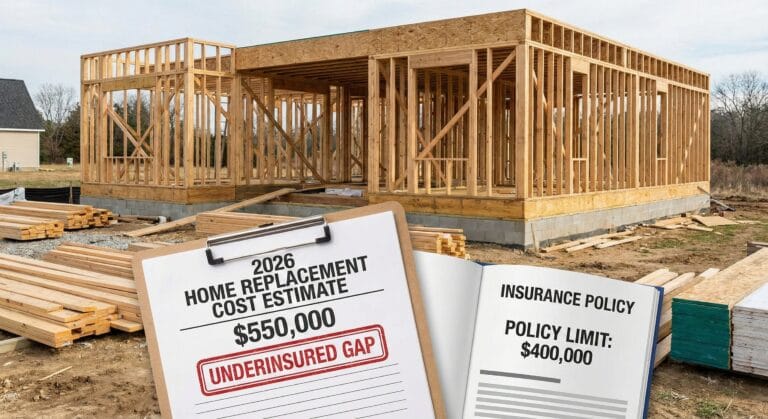

- Inflation & Reconstruction Costs: Even though general inflation has cooled, the cost of construction materials (lumber, roofing, copper) remains historically high. If your home is damaged, it simply costs more to rebuild it today than it did three years ago.

- Severe Weather Events: From wildfires in the West to stronger hurricanes in the Southeast, data from the National Weather Service confirms that extreme weather is causing billions in losses. Insurers are passing these risks on to policyholders.

- Reinsurance Rates: Insurance companies buy their own insurance (called reinsurance) to protect against massive disasters. The cost of reinsurance has skyrocketed, trickling down to your monthly premium.

Average Homeowners Insurance Cost 2026 by Region

While the national average for insurance has climbed to approximately $2,150 per year, rates vary wildly depending on where you live.

- The Southeast (FL, LA, TX): Homeowners here face the highest premiums, often exceeding $4,000 to $6,000 annually due to hurricane risk.

- The Midwest (OK, KS, NE): Tornado and hail risks keep premiums high, averaging around $3,200 annually.

- The West (CA, OR, WA): Wildfire risks have pushed rates up, though Proposition 103 in California creates unique regulatory challenges. Average premiums range from $1,500 to $2,500.

- The Northeast (NY, MA, PA): Generally more stable, with averages closer to $1,400 to $1,800, though coastal flooding remains a concern.

5 Proven Ways to Lower Your Premium

You cannot control the weather, but you can control how you manage your policy. Here are five steps to reduce your costs immediately.

1. Bundle Your Policies

This is the oldest trick in the book because it works. Purchasing your home and auto insurance from the same carrier can save you anywhere from 15% to 25% on both policies.

2. Raise Your Deductible

Many homeowners stick with a low $500 or $1,000 deductible out of habit. However, insurance should be for catastrophic losses, not minor repairs. Raising your deductible to $2,500 or $5,000 can drop your annual premium by up to 20%.

3. Review Your Budget

Before you commit to a policy, make sure the monthly payments fit your overall housing budget. You can use our Mortgage Calculator Guide 2026 to see how insurance impacts your total monthly payment.

4. Review Your “Dwelling Coverage”

Your policy should cover the cost to rebuild your home, not its market value. If your home is worth $500,000 but the land it sits on is worth $200,000, you only need to insure the structure for $300,000. Review these numbers with your agent to ensure you aren’t over-insuring.

5. Improve Your Credit Score

In most states (except California, Massachusetts, and Maryland), insurers use a credit-based insurance score to set rates. Statistics show that homeowners with higher credit scores file fewer claims.

Conclusion: Shop Around Every Year

Loyalty does not always pay off in the insurance world. If your rate has jumped more than 10% this year without a claim, it is time to shop around.

Get quotes from at least three different carriers. With the Homeowners Insurance Cost 2026 market being so volatile, a little bit of comparison shopping could save you hundreds of dollars a year.