Dropped by Home Insurance 2026: Non-Renewal Survival Guide

Getting a “Notice of Non-Renewal” in the mail is terrifying. In 2026, it is also becoming the new normal for millions of American homeowners.

While insurance rates are finally stabilizing (rising only ~8% this year compared to the massive 20% hikes of 2024-2025), insurers have shifted tactics. Instead of raising prices, they are simply dropping customers entirely to reduce their exposure to climate risks. Major carriers like State Farm, Allstate, and Farmers are tightening restrictions in “high-risk” zones, specifically in Florida, California, Texas, and Louisiana.

If you just received a cancellation letter, do not panic. You have options. This comprehensive guide covers why this is happening, how to appeal “drone errors,” and exactly how to find new coverage in 2026.

Why Were You Dropped? (The 3 Main Triggers)

In 2026, insurers are using advanced technology to decide who keeps coverage. It is rarely personal; it is algorithmic.

1. Satellite AI Inspections

This is the biggest change in the industry. Companies are now using high-definition satellite imagery and drones to scan your property without ever stepping foot on it.

- What they look for: Moss on the roof, overhanging tree branches, debris in the yard, or an undeclared trampoline.

- The Problem: AI often makes mistakes. It might flag a shadow as a “damaged roof” or a skylight as a “hole.” If the AI flags you, the non-renewal notice is sent automatically.

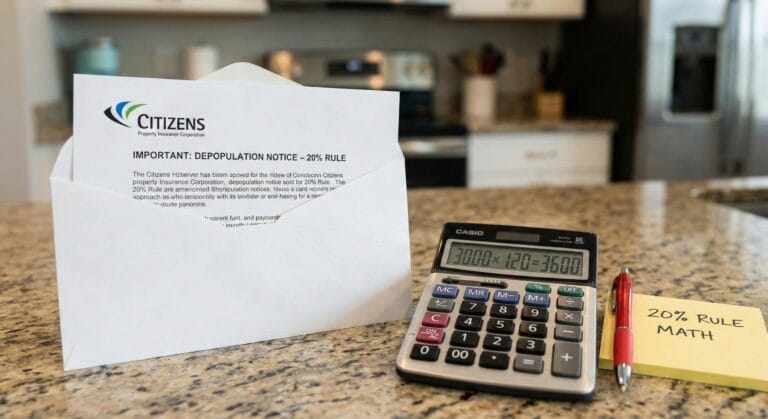

2. The “Depopulation” (Florida Only)

If you live in Florida and use Citizens Property Insurance, you are likely part of the state’s aggressive “Depopulation Program.” Citizens has dropped from 1.4 million policies to under 400,000 in early 2026.

- The Goal: The state wants to move policies back to private carriers. If you received a letter, it means a private company thinks your home is “safe enough” to insure.

3. Roof Age Limits

In the past, you could keep your insurance as long as your roof wasn’t leaking. In 2026, carriers have strict age limits.

- Asphalt Shingles: Many carriers now automatically deny coverage for roofs older than 15 years.

- Metal/Tile: Usually safe up to 20-30 years, but inspections are increasing.

Immediate Step: Check Your “CLUE” Report

Before you start calling agents, you need to know what they are seeing. Every insurer checks a database called the C.L.U.E. Report (Comprehensive Loss Underwriting Exchange).

This report lists every claim filed on your property in the last 7 years—even claims filed by the previous owner.

- The Risk: If the previous owner filed two claims for “Water Damage” in 2021, you might be flagged as “High Risk” even if you have never filed a claim yourself.

- Action: You can request a free copy of your CLUE report online (similar to a credit report). If you see errors, dispute them immediately with LexisNexis.

Step 1: Challenge the “Satellite Denial”

If your letter cites “Property Condition” or “Roof Debris,” do not accept it as final. You can often reverse this decision if you prove the AI was wrong.

How to Appeal:

- Clean the Roof: Immediately remove any moss, algae, or pine needles.

- Trim Trees: Cut back branches so they are at least 3-6 feet away from the roofline.

- Take Photos: Take clear, timestamped photos of the clean roof from multiple angles.

- Send an Appeal Letter: Email your agent with the photos.

Script for your Agent:

“I received a non-renewal notice based on ‘roof condition.’ I have verified that the roof is in good condition and free of debris. I have attached timestamped photos taken today showing the roof is clean and branches are trimmed. Please submit these to the underwriter for a reconsideration of the non-renewal.”

Step 2: The “20% Rule” (Florida Residents)

If you were dropped from Citizens in Florida, check your letter carefully. You likely received a “Takeout Offer” from a private company (like Slide, Typtap, or others).

The Law: Under Florida’s 2026 rules, if a private insurer offers you a policy that is within 20% of the cost of your Citizens premium, you are legally required to accept it. You cannot stay on Citizens.

- Action: Compare the quotes immediately. If the private offer is more than 20% higher than your Citizens rate, you can file a “Choice Form” to reject it and stay with the state plan.

Step 3: Look for “E&S” Insurance

If standard companies (known as “Admitted Carriers”) reject you, do not give up. You need to ask an independent broker about Excess & Surplus (E&S) Lines.

- What is it? These are specialized insurers (like Lloyd’s of London or Scottsdale Insurance) that are allowed to cover unique or high-risk homes that standard carriers reject.

- The Trade-off: E&S policies are typically 20-40% more expensive than standard policies. Also, they are not backed by the state guaranty fund (meaning if the company goes bankrupt, the state won’t bail you out).

- When to use it: This is often the only option for older homes with knob-and-tube wiring or homes in severe wildfire zones.

Step 4: The “Last Resort” Plans (FAIR Plans)

If absolutely no private company—standard or E&S—will insure you, you must apply for your state’s “Insurer of Last Resort.” This should be your final stop.

| State | Plan Name | 2026 Update |

| California | FAIR Plan | Now offers higher coverage limits ($3M), but wait times can be weeks. It covers Fire Only. |

| Florida | Citizens | Strict eligibility; you cannot join if a private offer exists within 20% of the price. |

| Louisiana | Citizens | The most expensive option in the state; use only if necessary. |

| Texas | TWIA | Required for wind/hail coverage in coastal counties like Galveston. |

The “DIC” Strategy (For FAIR Plan Users)

Most FAIR plans (especially in California) are “Named Peril” policies—they often only cover fire and smoke. They do not cover theft, liability, or water damage.

- The Fix: You must buy a separate “Difference in Conditions” (DIC) policy. This wraps around your FAIR plan to fill the gaps, giving you “full” coverage again. Ask your broker specifically for a “DIC Quote.”

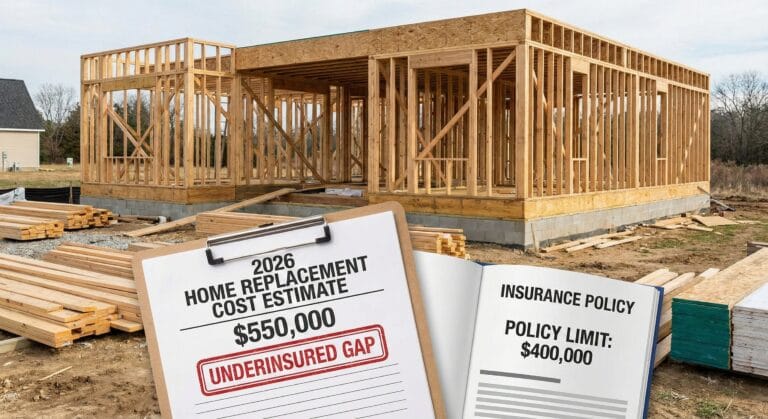

Summary: Don’t Let Your Mortgage Lapse

If you have a mortgage, you must have insurance. If your policy expires, your lender will be notified immediately. They will then buy “Force-Placed Insurance” for you.

- Why avoid this? Force-placed insurance is usually 2x to 3x more expensive than market rates and covers only the structure, not your belongings or your liability if someone gets hurt on your property.

Do not wait until the expiration date. Start shopping the day you get the letter. The market in 2026 is slow, and approval can take 2-3 weeks.