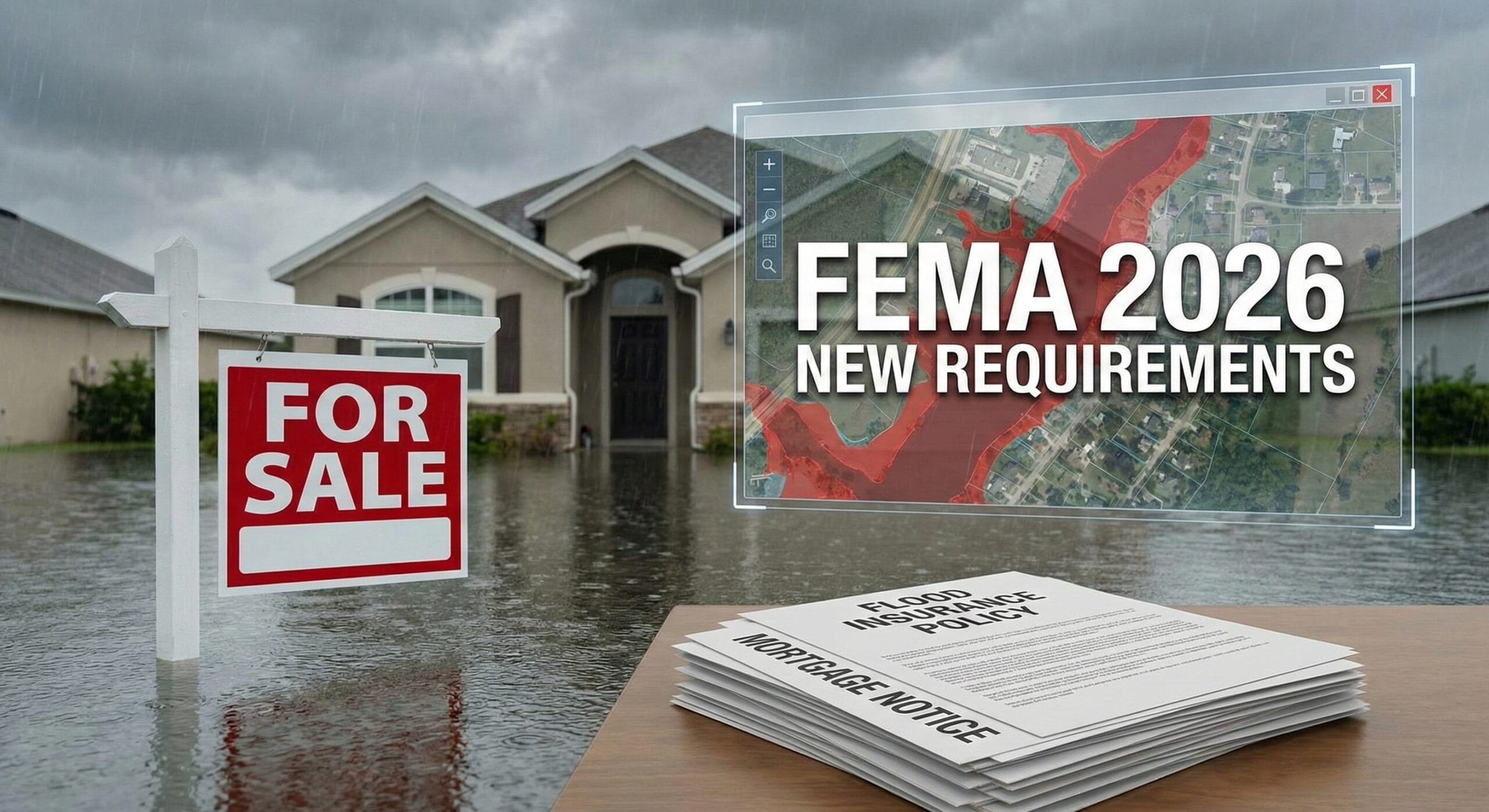

Flood Insurance Requirements 2026: New Maps & FEMA Rules

For decades, the standard for flood insurance requirements 2026 was simple. If you lived outside a high-risk “A Zone,” you didn’t need it. You could ignore the brochure and save the money.

In 2026, that rulebook is gone.

FEMA has fully implemented Risk Rating 2.0. At the same time, banks have tightened their lending standards. Now, millions of Americans are getting letters from their lenders demanding proof of coverage.

Are you buying a home or refinancing this year? You need to know the new flood insurance requirements 2026. This guide explains who must buy a policy and why the old maps are misleading. We also cover the hidden “waiting period” that could delay your closing.

The New “Mandatory” Flood Insurance Requirements 2026

Who must buy flood insurance in 2026? Federal laws and map updates have expanded the list.

1. FHA & USDA Flood Insurance Requirements 2026

The biggest change affects government-backed loans. Late last year, the FHA and USDA tightened their flood insurance requirements 2026 to protect taxpayers.

- The Rule: Does any part of your property touch a Special Flood Hazard Area (SFHA)? This includes your house, garage, or shed. If yes, you must buy coverage.

- The Change: In the past, you could argue for an exemption if the house itself was on high ground. In 2026, lenders use a “zero tolerance” approach. If the map touches your garage, you pay.

2. The “Climate Creep” Zones

FEMA updated its maps for 2026. These changes hit coastal states like Florida, Texas, and the Carolinas. They also affect inland river areas in Missouri and Kentucky.

- The Impact: FEMA reclassified thousands of homes from “Zone X” (Low Risk) to “Zone AE” (High Risk).

- The Result: Do you have a mortgage? If your zone changed, your lender will require you to buy insurance immediately.

The “Force-Placed” Insurance Trap

What happens if you ignore the letter from your bank? Your lender checks your zone status often. If they find you lack coverage, they will issue Force-Placed Insurance.

- What it is: The bank buys a policy for you. This protects their loan, not your wallet.

- The Cost: These policies are expensive. They often cost 2x to 3x more than a standard policy.

- The Coverage: It usually covers only the structure. It rarely covers your belongings.

- Avoidance: You must send proof of your own policy within 45 days. This will cancel the force-placed plan.

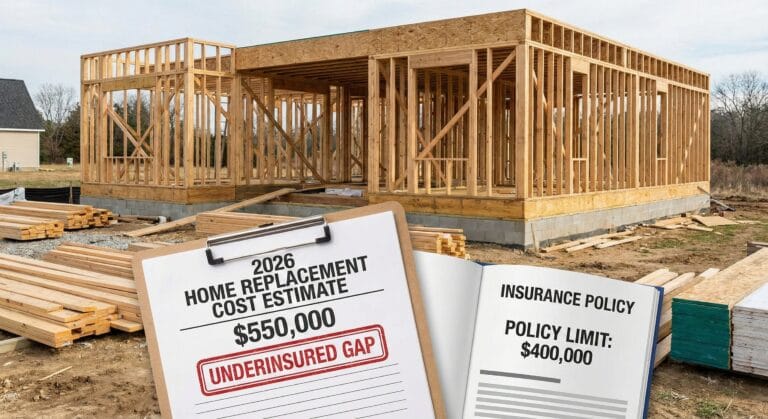

Risk Rating 2.0: No More “Grandfathering”

Long-time homeowners face a painful truth in 2026. “Grandfathering” is dead. Under the old system, you could keep your cheap rate even if the maps changed.

Under Risk Rating 2.0, FEMA calculates rates based on true risk. They look at distance to water, elevation, and rebuilding costs.

- The Glide Path: Suppose your true risk rate is $4,000 a year, but you pay $800. FEMA will raise your premium by 18% every year. This continues until you reach the full $4,000.

- The Reality: You cannot “lock in” a cheap rate anymore.

You can check your risk score on the official FEMA Flood Map Service Center. This will show if FEMA reclassified your property.

The 30-Day Waiting Period (Don’t Ignore This)

This rule delays many closings in 2026. If you buy a policy through the National Flood Insurance Program (NFIP), you face a mandatory 30-day waiting period. Coverage does not start immediately.

- The Problem: You might close on a house in 14 days. If you need flood insurance to satisfy the lender, the NFIP policy won’t be ready.

- The Exception: The rule waives the wait for a “loan closing.” But your paperwork must be perfect.

- The Alternative: Private flood insurance (see below) often has a wait of only 10–14 days. This can save a fast closing.

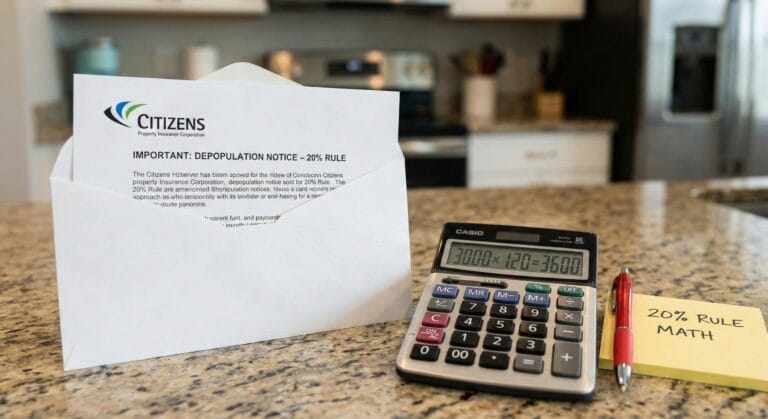

Private vs. Federal Flood Insurance Requirements 2026

With strict rules, homeowners often ask: Must I buy the government plan?

In 2026, the answer is often No. Federal regulators now require lenders to accept Private Flood Insurance. The policy just needs to meet strict criteria.

- The Benefit: Private plans often offer higher limits. The NFIP caps coverage at $250,000. Private plans can also cover “Loss of Use,” which pays for hotels during repairs.

Check FloodSmart.gov for official details on what the government plan covers.

Summary: Navigating Flood Insurance Requirements 2026

Stop assuming “it never floods here.” The new rules rely on data, not memory.

Action Plan:

- Check Your Map: Use the FEMA tool. See if your zone changed this year.

- Audit Your Mortgage: Do you have an FHA loan? Ensure you meet the rules to avoid force-placed insurance.

- Shop Private: Don’t just auto-renew the NFIP plan. Ask a broker to quote private options. You might find a better rate.

While you are auditing your insurance, don’t forget to check your auto policy. Read our guide on Car Insurance Rates 2026 to see if you are overpaying there, too.