Flood Insurance Requirements 2026: New Rules & Cost

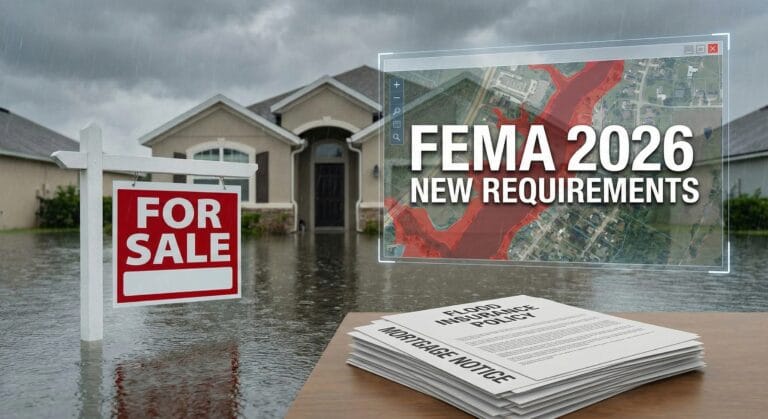

For decades, homeowners ignored flood insurance requirements, believing the myth: ‘If I don’t live in a flood zone, I don’t need coverage.’ In 2026, that logic is officially dead.

New flood insurance requirements from state insurers and mortgage lenders are forcing millions of Americans to buy coverage for the first time. Whether you are in Florida, California, or Texas, the rules have changed.

If you ignore these flood insurance requirements, you could lose your home insurance policy entirely. This guide explains the new 2026 mandates, the cost of FEMA’s “Risk Rating 2.0,” and the hidden traps—like the “50% Rule”—that could bankrupt you during a renovation.

Who Has Mandatory Flood Insurance Requirements?

In 2026, the map is no longer the only factor. Two major groups are now subject to strict flood insurance requirements, regardless of whether they have seen water before.

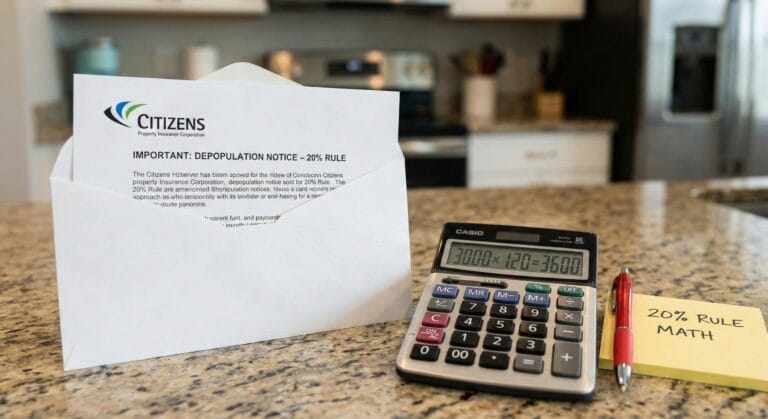

1. Citizens Property Insurance (Florida)

If you are one of the millions insured by Citizens in Florida, you are likely on a “glide path” to mandatory coverage. By 2026, nearly all Citizens policyholders—regardless of their flood zone—must carry a separate flood policy.

- The Rule: If your home’s replacement cost is over a certain limit (often $600k in 2026), you generally must have flood coverage to keep your Citizens wind policy.

- The Penalty: Failure to provide proof of flood insurance will result in the immediate non-renewal of your Citizens policy (see Citizens Depopulation Letter 2026).

2. FHA and USDA Borrowers

Federal flood insurance requirements have also tightened. If you have a government-backed mortgage (FHA, VA, or USDA) and live in a designated “Special Flood Hazard Area” (Zones A or V), coverage is non-negotiable. However, in 2026, lenders are increasingly requiring flood insurance even in “Zone X” (low risk) areas due to changing climate models.

Understanding Coverage: Building vs. Contents

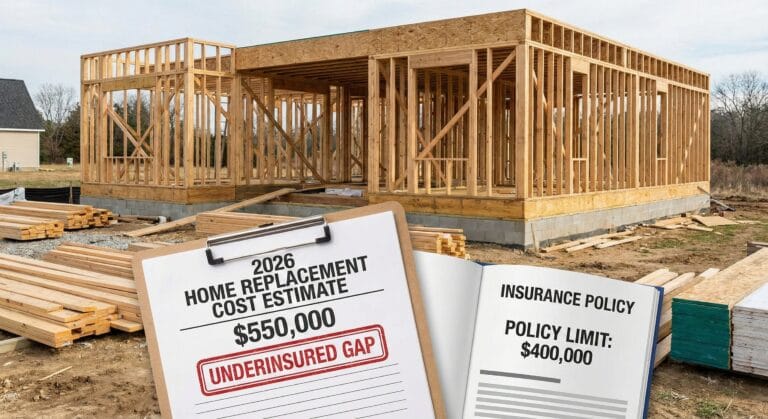

One of the biggest mistakes homeowners make when trying to meet flood insurance requirements is assuming one policy covers everything. Unlike standard home insurance, flood insurance is split into two distinct parts. You usually have to buy them separately.

1. Building Property Coverage This covers the structure itself. It includes:

- Electrical and plumbing systems.

- Furnaces and water heaters.

- Built-in appliances (dishwashers).

- Permanently installed carpeting.

2. Personal Contents Coverage This covers your stuff. It includes:

- Clothing and furniture.

- Electronics (TVs, computers).

- Portable appliances (microwaves).

- Curtains and washer/dryers.

The Trap: If you buy a policy to satisfy your lender’s flood insurance requirements, they often only care about the Building coverage. If you don’t explicitly ask for Contents coverage, you could be left with a dry house but no furniture after a storm.

FEMA Risk Rating 2.0 and Flood Insurance Requirements

The old way of pricing flood insurance is gone. FEMA’s Risk Rating 2.0 is now fully implemented. Instead of just looking at your “Zone,” FEMA now calculates your flood insurance requirements and price based on:

- Distance to water: How close is the river or coast?

- Rebuild Cost: Expensive homes pay more.

- Flood Type: River overflow vs. storm surge.

The Result: Many homeowners have seen premiums double. If you are facing a $4,000+ renewal, you need to shop around.

The 50% Rule and Renovation Flood Insurance Requirements

There is a hidden clause in the flood insurance requirements that catches renovators off guard. It is called the Substantial Improvement Rule (or the “50% Rule”).

How it works: If you remodel your home, and the cost of the renovation equals or exceeds 50% of the home’s market value (pre-renovation), you must bring the entire house up to current flood codes.

Example:

- Home Value: $200,000 (structure only).

- Renovation Budget: $110,000.

- Result: You are spending 55% of the value.

- The Consequence: You might be forced to elevate your home on stilts or install flood vents before the city will grant you a permit.

This rule is strictly enforced in 2026. Before you start a major kitchen remodel in a flood zone, check if you are triggering these new flood insurance requirements.

Private Flood Insurance vs. FEMA (NFIP)

Because FEMA rates have spiked, the flood insurance requirements can sometimes be met with a “Private” policy. Private insurers (like Neptune, Wright, or others) use different data models.

- Pros of Private:

- Often 20-40% cheaper than FEMA.

- Higher coverage limits (FEMA caps at $250,000 for the structure).

- Shorter wait times (10-14 days vs. FEMA’s 30 days).

- Cons of Private:

- If the private company goes bust, you might lose coverage.

- Some FHA loans have stricter rules about which private policies they accept.

Always check with your lender to ensure a private policy satisfies their flood insurance requirements.

3 Ways to Lower Your Flood Premium

If your quote is too high, don’t just accept it. There are ways to lower the cost while still meeting flood insurance requirements.

- Elevation Certificate (EC): Under Risk Rating 2.0, an EC is no longer mandatory, but it can still help. If your home is elevated higher than FEMA estimates, submitting an EC can drop your rate.

- Install Flood Vents: If you have a crawlspace, installing proper “Smart Vents” allows water to flow through without destroying the foundation. This can lower your premium significantly.

- Increase the Deductible: Raising your deductible from $1,000 to $5,000 can reduce your monthly payment, but ensure you have the cash savings to cover it.

Waiting Periods: Don’t Wait for the Storm

One of the most dangerous misunderstandings about flood insurance requirements is the “Waiting Period.” You cannot buy a policy today and be covered tomorrow.

- FEMA (NFIP): Strict 30-day waiting period. If a storm is named, it’s too late.

- Loan Exception: If you are buying a house (closing on a new mortgage), the wait period is waived.

- Private Policies: Usually have a 10-15 day waiting period.

If you are currently looking for a new policy because you were dropped, check our guide on [Link to: Dropped by Home Insurance 2026] to manage your timeline.

Summary: Protect Your Asset

Water damage is almost never covered by a standard home insurance policy. Meeting the flood insurance requirements isn’t just about obeying the bank—it’s about survival.

Action Plan:

- Check Your Zone: Look at the updated FEMA maps.

- Quote Private: Don’t just accept the FEMA renewal; ask a broker for private options.

- Watch the 50% Rule: Be careful with renovations in flood zones.

For official maps and risk data, always refer to the FEMA Flood Map Service Center.