Home Buyer Grants 2026: First-Time Loans & Programs

Finding the best First-Time Home Buyer Grants in 2026 can be the difference between renting for another year or owning your dream home. With mortgage rates stabilizing and inventory returning, 2026 offers a unique window of opportunity. However, the biggest barrier remains the down payment.

However, the biggest barrier remains the down payment.

The good news is that 2026 has brought higher loan limits and renewed access to low-down-payment programs. Whether you need a 0% down loan or a government grant to cover your closing costs, this guide covers the best options available right now.

Quick Comparison: The Top 4 Loan Programs for 2026

| Loan Type | Minimum Down Payment | Minimum Credit Score | Best For… |

| FHA Loan | 3.5% | 580 | Buyers with lower credit scores. |

| USDA Loan | 0% | 640 (typically) | Buyers in rural/suburban areas. |

| VA Loan | 0% | None (set by lender) | Veterans & Active Duty Military. |

| Conventional | 3% | 620 | Buyers with good credit (to avoid permanent PMI). |

1. FHA Loans (The Low-Credit Safety Net)

The Federal Housing Administration (FHA) loan is the most popular choice for first-time buyers because it is more forgiving of credit bumps than any other program.

- Minimum Down Payment: 3.5% (if your credit score is 580+).

- Credit Score: You can qualify with a score as low as 500 if you can put 10% down, though most lenders look for 580.

- 2026 Loan Limits: The FHA has increased its loan limits for 2026. The “floor” (for low-cost areas) is now $541,287, and the “ceiling” (for high-cost areas like NYC or LA) is $1,249,125.

The Catch: You must pay a Mortgage Insurance Premium (MIP) for the life of the loan if you put less than 10% down. It does not fall off automatically like it does with conventional loans.

📉 Read the full guide: FHA Loan Requirements 2026: Credit Score, Income & Limits

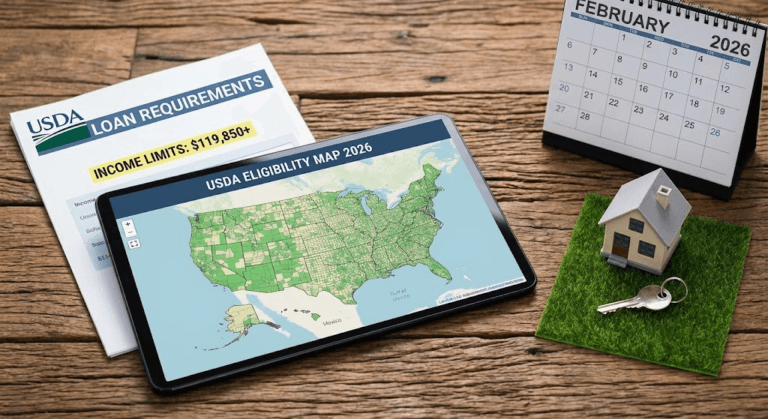

2. USDA Loans (0% Down for “Rural” Areas)

Many buyers assume “rural” means farmland. In reality, the USDA defines “rural” loosely. Many small towns and suburbs just outside major cities qualify for this 0% down program.

- Minimum Down Payment: 0% (No money down required).

- Mortgage Insurance: Much lower than FHA.

- 2026 Income Limits: To qualify, you cannot earn more than 115% of the local median income. For most of the US in 2026, this limit is approximately $119,850 for a household of 1–4 people.

The Catch: You must buy a home in a designated USDA-eligible area. You can check your specific address on the USDA eligibility map.

3. VA Loans (The Best Mortgage in America)

If you are a Veteran, Active Duty service member, or a surviving spouse, you should almost always choose the VA loan. It is statistically the cheapest way to buy a home.

- Minimum Down Payment: 0%.

- PMI: None. This is the only low-down-payment loan that never charges monthly mortgage insurance.

- 2026 Loan Limits: For veterans with full entitlement, there is no limit on how much you can borrow with 0% down (as long as you can afford the payments). For those with partial entitlement, the limit generally tracks the conforming limit of $832,750.

The Catch: You must have a valid Certificate of Eligibility (COE) from the VA.

4. Conventional 97 (Fannie Mae HomeReady)

Many buyers think they need 20% down for a “standard” bank loan. In 2026, that is false. Fannie Mae and Freddie Mac offer specific programs for first-time buyers that require only 3% down.

- Programs: Ask your lender for Fannie Mae HomeReady or Freddie Mac Home Possible.

- Minimum Down Payment: 3%.

- 2026 Conforming Limit: You can now borrow up to $832,750 in most areas without needing a Jumbo loan.

- The Big Benefit: Unlike FHA, the private mortgage insurance (PMI) falls off automatically once you build 20% equity in the home.

5. The “Hidden Gem”: Good Neighbor Next Door

This is widely considered the most aggressive housing discount program in the United States. It is managed by HUD (Department of Housing and Urban Development).

- The Deal: You can buy a home for 50% off the list price.

- Example: If a home is listed for $200,000, you buy it for $100,000.

- Who Qualifies:

- Law Enforcement Officers

- Pre-K through 12th-grade Teachers

- Firefighters

- EMTs / Paramedics

- The Catch: You must live in the home for 36 months (3 years) as your primary residence. Also, the home must be located in a designated “Revitalization Area”.

Best First-Time Home Buyer Grants & DPA Programs

If you can afford the monthly mortgage payment but struggle to save the upfront cash for closing costs, DPA programs can bridge the gap.

- Chenoa Fund: A national DPA program that offers up to 3.5% or 5% assistance, which can sometimes be forgivable if you make on-time payments.

- State Housing Finance Agencies (HFAs): Every state has its own agency (e.g., CalHFA in California, SONYMA in New York, TSAHC in Texas). These agencies often offer grants that do not need to be repaid.

🧮 Do the math: How Much House Can I Afford? The 2026 Mortgage Calculator Guide

Summary: Which Loan is Right for You?

Reviewing these Home Buyer Grants and loan options is the best way to prepare for your purchase.

- Credit Score under 620? Start with FHA.

- Veteran? Always use VA.

- Willing to commute? Check the USDA map for 0% down.

- Teacher or First Responder? Check the Good Neighbor Next Door listings first.

- Good Credit (680+)? Use a Conventional Loan to save money on insurance long-term.