FHA Loan Requirements 2026: Credit Score, Income & Limits

For millions of Americans, understanding the FHA Loan Requirements is the only path to homeownership.

Backed by the Federal Housing Administration, this loan is designed specifically for buyers who don’t have perfect credit or a massive down payment. In 2026, the rules have become even more favorable, with higher loan limits and relaxed income requirements.

If you have been denied a conventional bank loan, this guide is for you.

1. FHA Loan Requirements: The Core Rules

To qualify for an FHA loan in 2026, you must meet these four basic criteria:

- Credit Score: Minimum 580 (for 3.5% down) or 500 (for 10% down).

- Down Payment: 3.5% is the standard minimum.

- DTI Ratio: Your total debt payments usually cannot exceed 43% of your income.

- Occupancy: You must live in the home as your primary residence.

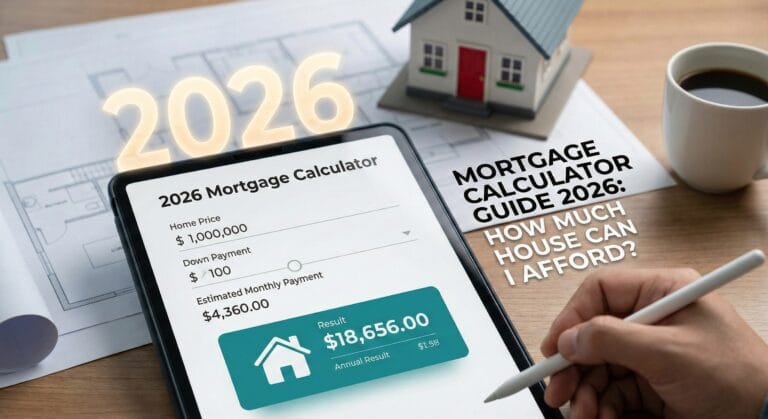

🧮 Check your math: How Much House Can I Afford? The 2026 Mortgage Calculator Guide

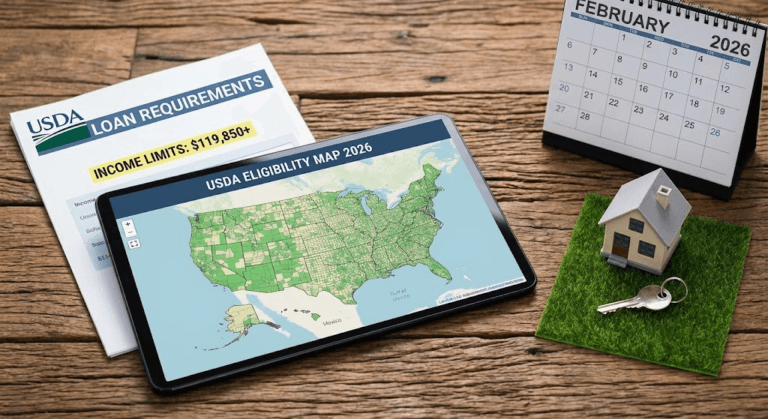

2. 2026 FHA Loan Limits

The most exciting update for this year is the increase in how much you can borrow.

- Standard Limit (Low-Cost Areas): $541,287

- High-Cost Areas (e.g., California, NYC): $1,249,125

Note: These limits vary by county. If you are buying a duplex (2-unit home) to live in one unit and rent the other, these limits are even higher.

3. The “Credit Score” Rule Explained

Many buyers are confused about the 580 vs. 500 rule.

- If your score is 580+: You qualify for maximum financing. You only need to put down 3.5%. (On a $300,000 home, that is just $10,500).

- If your score is 500-579: You can still qualify, but you must put down 10%.

- If your score is below 500: You generally will not qualify until you improve your score.

💸 Need help with the cash? Home Buyer Grants 2026: First-Time Loans & Programs

4. Mortgage Insurance (MIP) – The Catch

The “price” you pay for these easy FHA Loan Requirements is Mortgage Insurance Premium (MIP). Unlike conventional loans, FHA requires two types:

- Upfront MIP: A one-time fee of 1.75% of the loan amount (added to your loan balance).

- Annual MIP: A monthly fee (usually 0.55%) added to your mortgage payment.

5. Can I Buy a Home with Student Loans?

Yes. FHA rules for student loans are designed to help borrowers.

- The Rule: Lenders will use 0.5% of your total student loan balance as your estimated monthly payment (if your actual payment is $0 on an IDR plan).

- This makes it much easier to qualify compared to older bank rules.

6. FHA vs. Conventional: Which is Better?

- Choose FHA if: Your credit score is under 680, or you have a high debt-to-income ratio.

- Choose Conventional if: Your credit score is 720+ and you have at least 5% down. Conventional loans are cheaper in the long run because you can cancel the private mortgage insurance (PMI).

Summary

The FHA loan remains the best tool for first-time buyers in 2026. With the new loan limit of $541,287, you have plenty of buying power. Review these FHA Loan Requirements with a lender today to start your journey.