Conventional Loan Requirements 2026: 3% Down & PMI Rules

For most home buyers, meeting the conventional loan requirements is the gold standard for financing a home. Unlike government-backed options, these loans offer less red tape, no upfront funding fees, and Private Mortgage Insurance (PMI) that actually falls off.

However, because the government isn’t insuring the risk, the conventional loan requirements in 2026 are stricter than FHA or USDA loans. If your credit score has taken a hit or your debt load is high, qualifying can be a challenge.

This guide breaks down the official conventional loan requirements for 2026, including the new conforming loan limits, the “3% Down” myth, and exactly what score you need to get the best rate.

The Core Conventional Loan Requirements 2026

Conventional loans follow guidelines set by Fannie Mae and Freddie Mac. In 2026, these giants have adjusted their rules to keep up with inflation and home prices.

To qualify, you generally need to meet these three conventional loan requirements:

- Credit Score: A minimum of 620 is the hard deck.

- Down Payment: As low as 3% for first-time buyers.

- DTI Ratio: Your total debts usually cannot exceed 43% to 50% of your income.

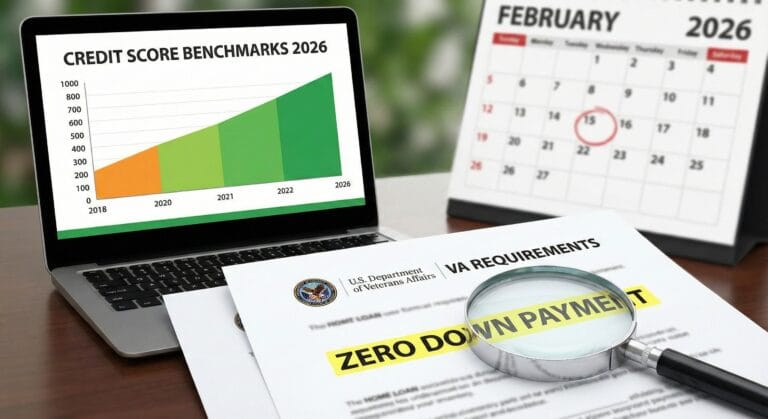

1. Credit Score and Conventional Loan Requirements

The most rigid of all conventional loan requirements is the credit score. Unlike FHA loans, which allow scores down to 580, conventional lenders rarely budge below 620.

- 620–679: You can qualify, but you will pay a higher interest rate and expensive PMI.

- 680–739: This is the “sweet spot” where rates become competitive.

- 740+: You unlock the lowest rates and cheapest PMI available.

If your score is sitting at 610, do not apply for a conventional loan yet. You will be denied. Instead, look at the FHA Loan Requirements 2026, which is designed specifically for scores in that range.

2. Down Payment Conventional Loan Requirements

A common myth is that you need 20% down to meet conventional loan requirements. This is false. In 2026, two specific programs allow for just 3% down:

- Conventional 97: For first-time home buyers.

- HomeReady / Home Possible: For low-to-moderate income borrowers.

Why pay 20% then? Putting 20% down allows you to avoid Private Mortgage Insurance (PMI) entirely. If you put down less, you must pay PMI until you build enough equity.

3. PMI: The Conventional Advantage

The biggest reason buyers strive to meet conventional loan requirements is how PMI works. On an FHA loan, mortgage insurance is permanent (life of the loan). On a Conventional loan, it is temporary.

How to remove it: Once your loan balance drops to 78% of the home’s original value, the PMI is automatically cancelled. You don’t have to refinance to get rid of it.

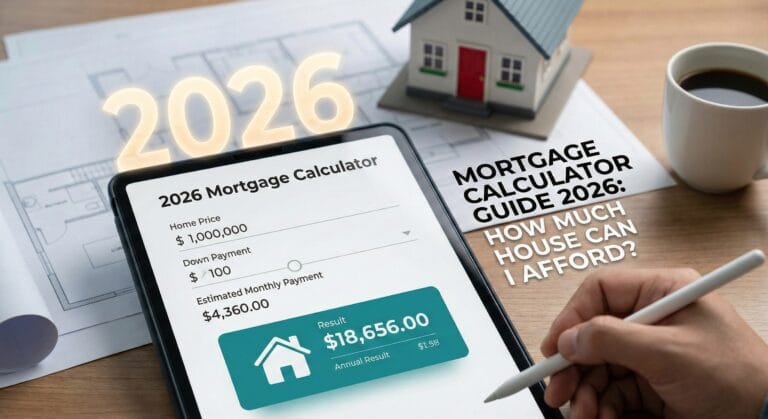

4. 2026 Conforming Loan Limits

To qualify as a “Conforming” conventional loan, the amount you borrow must stay under the federal cap. For 2026, the FHFA has raised these limits significantly.

- Standard Limit: $832,750 (for most U.S. counties).

- High-Cost Limit: $1,249,125 (for areas like LA, NYC, DC).

You can check the exact limit for your county on the Official FHFA Conforming Loan Map. If you need to borrow more than this, you will fail the conventional loan requirements and must apply for a Jumbo Loan.

5. DTI and Income Rules

The final hurdle in the conventional loan requirements is your Debt-to-Income (DTI) ratio. Lenders look at your “Back-End Ratio”—your total monthly debt payments divided by your gross monthly income.

- Standard Cap: 43%.

- Exception Cap: 50% (Allowed if you have a high credit score or significant cash reserves).

Student Loans: Fannie Mae calculates student loans differently than FHA. If you are on an Income-Driven Repayment (IDR) plan, conventional lenders will often use your actual low payment ($0 or $50) rather than the 1% rule used by other programs. (See our guide on [Link to: FHA Student Loan Guidelines 2026] for the comparison).

Summary: Meeting Conventional Loan Requirements

Meeting the conventional loan requirements is the best path for borrowers with good credit (680+) and stable income. It offers the cheapest long-term costs because the mortgage insurance disappears.

Quick Comparison:

- Low Credit (580-619)? Go FHA.

- Veteran? Go VA Loan Requirements 2026.

- Rural Area? Go USDA Loan Requirements 2026.

- Good Credit (620+)? Stick with Conventional.

If you are ready to apply, gather your pay stubs and W2s now. The conventional loan requirements for documentation are strict, and gaps in employment will need a written explanation.