Citizens Depopulation Letter 2026: The “20% Rule” Explained

If you live in Florida and insure your home through Citizens Property Insurance Corporation, you likely received a thick envelope in the mail recently. This document, officially known as a Citizens depopulation letter, is part of the state’s aggressive effort to move policies back to the private market.

In the past, many homeowners would simply throw this Citizens depopulation letter in the trash and automatically renew their state coverage. However, in 2026, you cannot ignore it.

If you have already been Dropped by Home Insurance 2026, you understand how stressful this market is. Unfortunately, thanks to the strict “20% Rule” mandated by recent Florida legislation (Senate Bill 2-A), your ability to stay with Citizens is no longer guaranteed.

This comprehensive guide explains exactly how to read your Citizens depopulation letter, how to calculate the “20% Rule,” and the specific steps to opt out if you are eligible.

What Is a Citizens Depopulation Letter?

The state of Florida creates “Depopulation Programs” to shrink Citizens. Originally, Citizens was designed to be an “insurer of last resort,” not the largest insurer in the state.

Consequently, when private insurance companies (like Slide, Typtap, or American Integrity) feel financially stable, they can request to “take out” policies. Your Citizens depopulation letter is the official notice that one of these companies wants your specific policy.

Why did I get this now? Insurers usually send these offers in batches. In 2026, hundreds of thousands of letters are going out. The letter typically includes:

- The name of the private insurer offering coverage.

- The proposed premium (price) for the new policy.

- A “Coverage Comparison Worksheet.”

The “20% Rule” in Your Citizens Depopulation Letter

The most critical part of your Citizens depopulation letter is the price comparison. This is because Florida law now restricts who is allowed to decline these offers.

The Rule: If the private insurance company offers you a premium that is within 20% of your estimated Citizens renewal price, you are ineligible to stay with Citizens.

Generally, you have two options:

- Accept the Offer: You simply do nothing, and your policy automatically moves.

- Shop Around: Alternatively, you can find another carrier, but you cannot renew with Citizens.

The Exception (How to Stay): You can only reject the offer if the premium listed in your Citizens depopulation letter is more than 20% higher than your Citizens renewal estimate.

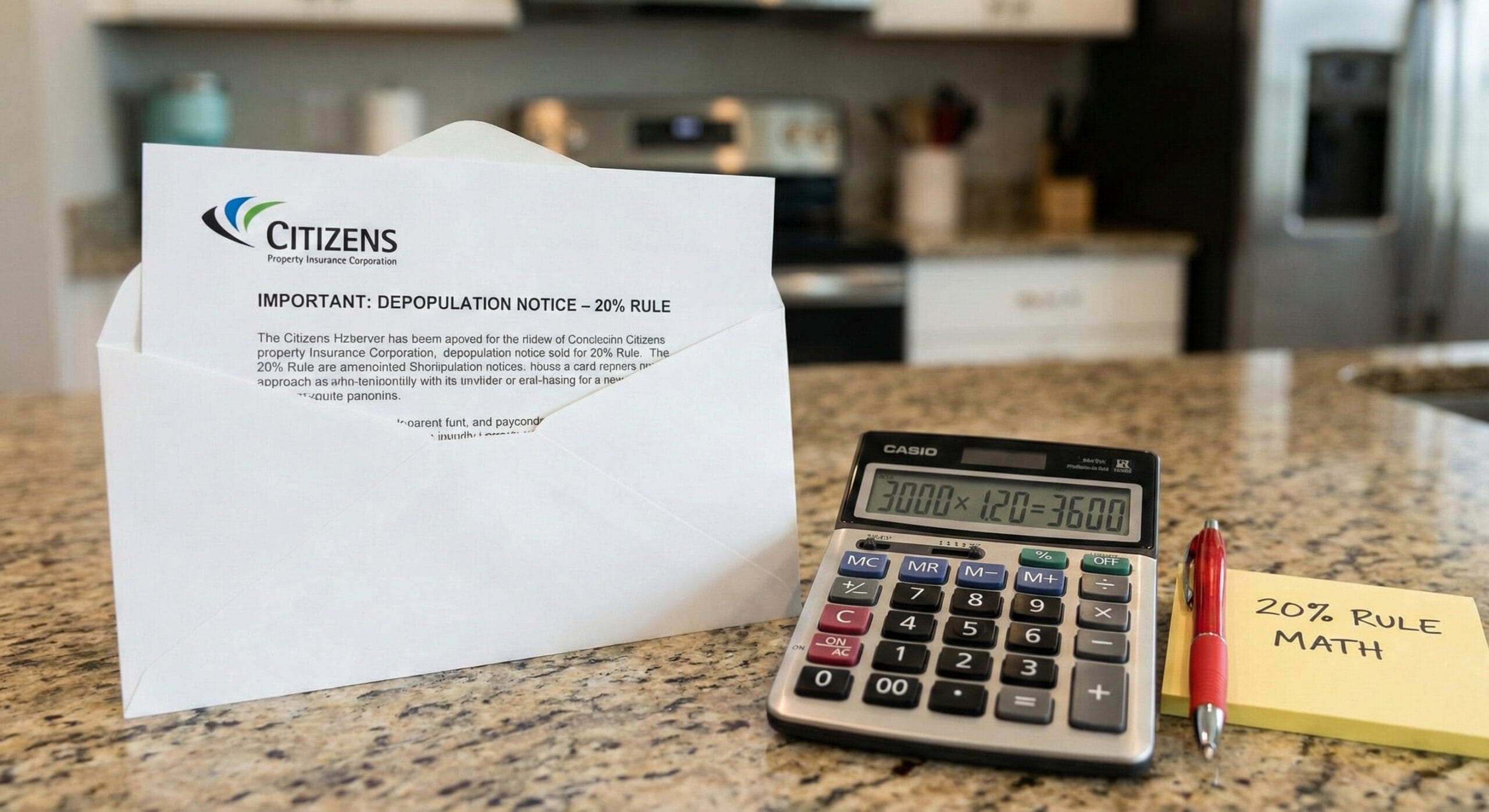

How to Analyze Your Citizens Depopulation Letter Math

Do not guess. You need to verify the math yourself because the “estimated renewal” figures can be confusing. Therefore, look closely at the “Coverage Comparison Worksheet” included in your packet.

Step 1: Find the Numbers First, locate the Citizens Estimated Renewal Premium and the Private Carrier Proposed Premium.

Step 2: Calculate the Cap Next, multiply your Citizens price by 1.20.

Step 3: Compare

- Scenario A (You Must Leave):

- Citizens Price: $3,000

- Private Offer: $3,500

- Calculation: $3,000 x 1.20 = $3,600.

- Result: Since the private offer ($3,500) is less than the 20% cap ($3,600), you have no choice. As a result, you must leave Citizens.

- Scenario B (You Can Stay):

- Citizens Price: $3,000

- Private Offer: $4,000

- Result: The offer is more than 20% higher. Therefore, you can legally “Opt-Out” and keep your Citizens policy.

Who Are These Private Companies?

You might not recognize the names on your Citizens depopulation letter. Many are newer “InsurTech” companies or Florida-specific carriers.

For instance, common 2026 carriers include:

- Slide Insurance: An aggressive buyer of policies in Tampa and Orlando.

- Typtap Insurance: Known for using technology to quote rapidly.

- American Integrity: A long-standing Florida carrier.

Before accepting, you should check their financial stability. Specifically, you can verify their ratings and complaint history on the official Florida Office of Insurance Regulation website.

The “Assumption” Trap: What Happens If You Do Nothing?

This is where thousands of Floridians get stuck. The process is designed to be “Opt-Out,” not “Opt-In.”

If you ignore your Citizens depopulation letter or forget to register your choice by the deadline, Citizens will automatically assign you to the private company.

The Timeline of Assumption:

- Notification: You receive the letter about 45 days before the “Assumption Date.”

- Decision Window: Next, you have roughly 30 days to register your decision online.

- Assumption Date: Finally, your policy officially transfers.

- No Turning Back: Once you are moved, the decision is final.

Responding to Your Citizens Depopulation Letter Online

If your math shows the offer is too high and you are eligible to stay, do not rely on snail mail. Instead, register your choice online immediately.

- Go to the Website: Visit the URL listed in your letter (usually

www.citizensfla.com/depopulation). - Enter Your Code: Find the “Registration Code” printed on the first page of your Citizens depopulation letter.

- Select Your Choice: Click “I wish to remain with Citizens Property Insurance Corporation.”

- Save the Confirmation: Finally, take a screenshot or print the confirmation page.

Summary: Take Action Today

The arrival of a Citizens depopulation letter is stressful, but it doesn’t have to be a disaster.

- Open the mail immediately.

- Do the 20% calculation.

- Check the company’s rating.

- Register your choice online.

If you are forced to leave, use this opportunity to shop around. Just because Slide or Typtap made you an offer doesn’t mean they are your only option. Therefore, contact a local independent broker to see if another carrier can beat their price.