California FAIR Plan 2026: Rates, Wait Times & New “Brush” Rules

If you have received a non-renewal notice from State Farm, Allstate, or Farmers, you are likely staring at an application for the California FAIR Plan.

Once considered a temporary safety net, the California FAIR Plan has become the only option for over 668,000 homeowners in the state. But in 2026, simply applying isn’t enough.

With a requested 35.8% rate increase and strict new wildfire mitigation requirements, getting coverage is harder—and more expensive—than ever before.

This guide explains the new 2026 California FAIR Plan rules, how to handle the “Brush Clearing” inspections, and what to do if you are stuck in the waiting period.

What Is the California FAIR Plan in 2026?

The California FAIR Plan is a “syndicate” insurance pool. It is not a state agency, but it is regulated by the state. It exists to provide basic fire insurance to people who cannot find coverage in the private market.

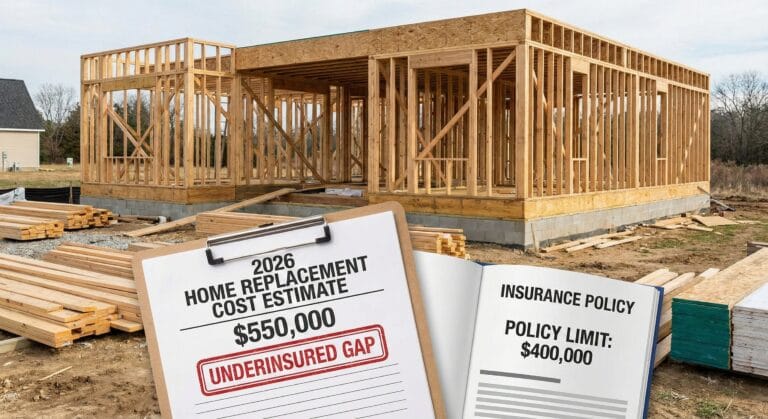

Crucial Warning: The California FAIR Plan is a “Named Peril” policy. It covers Fire and Smoke only. It does NOT cover:

- Theft

- Liability (if someone gets hurt on your property)

- Water Damage (burst pipes)

To be fully protected, you must buy a separate “Difference in Conditions” (DIC) policy to wrap around your California FAIR Plan coverage.

The 2026 Rate Hike: Brace for Sticker Shock

If you thought your old premium was high, 2026 will be a shock. The California FAIR Plan has officially requested an average rate increase of 35.8%.

- Why? For the first time, the state is allowing the plan to use “Wildfire Catastrophe Models” to set prices, rather than just looking at past losses.

- Commercial Properties: If you own a business or condo association, limits have increased to $20 million per building (up from $8.4 million), but premiums have skyrocketed to match.

If this pricing is unaffordable, check my guide on Homeowners Insurance Cost 2026 to see if you can bundle a DIC policy to save money.

New “Brush Clearing” Requirements (Defensible Space)

Getting a policy is no longer automatic. In 2026, the California FAIR Plan is aggressively inspecting properties for “Defensible Space.”

If you fail the inspection, you can be dropped.

The “Zone 0” Rule (0-5 Feet): New regulations require an “Ember-Resistant Zone” immediately around your house.

- No mulch or wood chips touching the house.

- No flammable plants under windows.

- Fences: Wooden gates attached to the house must often be replaced with metal.

The “Zone 1” Rule (5-30 Feet):

- Trees must be trimmed 10 feet away from the chimney.

- Grass must be cut to 4 inches or lower.

Wait Times: Why Is It Taking So Long?

In 2026, California FAIR Plan wait times have ballooned. Because private insurers are dropping thousands of customers a month (see Dropped by Home Insurance 2026), the FAIR Plan is overwhelmed with 17,000+ new applications monthly.

Typical Timeline:

- Broker Submits App: Day 1.

- Quote Issued: 5–15 Days.

- Payment Processing: 3–5 Days.

- Inspection: Occurs after the policy starts (usually within 90 days).

Pro Tip: Thanks to AB 290, a new law effective April 2026, the California FAIR Plan is finally implementing an automatic monthly payment plan option. You no longer have to pay the full annual premium upfront if you can’t afford it.

How to Get Off the FAIR Plan (Depopulation)

The goal is not to stay on the California FAIR Plan forever. The state has a “Clearinghouse” program where private insurers can look at FAIR Plan policies and offer to “take them out.”

How to make yourself attractive to private insurers:

- Certify Your Roof: If you have a Class A fire-rated roof, ensure it is listed on your application.

- Firewise Community: If you live in a “Firewise USA” certified community, you are eligible for a discount and are more likely to be picked up by a private carrier.

- Documentation: Take photos of your cleared brush and upload them.

Summary: Surviving the Market

The California FAIR Plan is a lifeline, but it is expensive and limited.

- Budget: Prepare for the 35% rate increase.

- Clean Up: Clear your brush before the inspector arrives.

- Wrap It: Never rely on the California FAIR Plan alone—always buy a DIC policy for liability and water damage.

For official updates on your application status or to make a payment, always use the <a href=”https://www.cfpnet.com” target=”_blank” rel=”noopener”>Official California FAIR Plan Website</a>.