Auto Insurance Deductible: Navigating Costs and Coverage

Auto insurance is a crucial part of dependable vehicle possession, giving monetary security if there should be an occurrence of mishaps or unanticipated occasions. One critical component inside an auto insurance strategy is the deductible, the sum the policyholder consents to pay personal before the insurance coverage kicks in. Understanding the subtleties of auto insurance deductibles is fundamental for settling on informed conclusions about costs and coverage.

Introduction

What is an Auto Insurance Deductible?

An auto insurance deductible is the foreordained sum the policyholder should contribute toward fix or substitution costs before the insurance coverage produces results. It goes about as a type of self-insurance, imparting the monetary obligation to the insurance supplier. Auto Insurance Deductible: Navigating Costs and Coverage

Significance of Understanding Auto Insurance Deductibles

Why Knowing Your Deductible Matters

Knowing your auto insurance deductible is urgent for going with informed choices during strategy determination and while recording a case. It straightforwardly influences the general expense of insurance and the amount you’ll pay in case of a mishap.

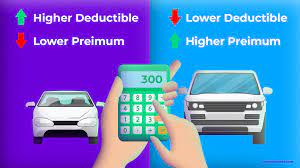

Effect on Expenses

Auto insurance deductibles straightforwardly affect expenses. Higher deductibles frequently bring about lower expenses, yet it’s fundamental for find some kind of harmony to guarantee satisfactory coverage without causing monetary strain.

Sorts of Auto Insurance Deductibles

Standard Deductibles

Standard deductibles are the default sums set by insurance organizations. Understanding these standard deductibles is vital to assessing strategy choices.

Thorough Deductibles

Thorough deductibles apply to non-crash occasions, like burglary, vandalism, or catastrophic events. Approaches might have separate deductibles for exhaustive and impact coverage.

Crash Deductibles

Crash deductibles apply to harm coming about because of impacts with different vehicles or items. Policyholders should understand the ramifications of impact deductibles on generally coverage.

Picking the Right Sort

Choosing the right kind of deductible relies upon individual inclinations, risk resilience, and spending plan contemplations. Assessing each type’s upsides and downsides helps in settling on an educated choice.

Deciding the Right Deductible Sum

Variables to Consider

Factors like individual accounting records, driving propensities, and the worth of the guaranteed vehicle ought to impact the decision of deductible sum.

Adjusting Costs and Coverage

Adjusting costs and coverage guarantees that the picked deductible is reasonable yet gives adequate monetary security in the event of a mishap.

Keep expanding on each heading and subheading, giving itemized data in a conversational style. Make sure to draw in the peruser, utilize individual pronouns, and keep a conversational tone.

Conclusion

In conclusion, navigating auto insurance deductibles includes cautious thought of different variables, including individual budgets, coverage needs, and the kind of vehicle protected. By understanding the complexities of deductibles and their effect on charges, policyholders can pursue informed choices that line up with their monetary objectives and give sufficient assurance out and about.

FAQs

Could I at any point change my deductible in the wake of buying an insurance strategy?

Indeed, numerous insurance suppliers permit policyholders to change their deductibles, however it’s vital for survey the terms and expected influences on expenses.

How does a higher deductible influence my month to month charges?

For the most part, choosing a higher deductible can bring down month to month expenses, however surveying the monetary ramifications in the event of a claim is essential.

How would it be advisable for me to respond on the off chance that I can’t manage the cost of my deductible after a mishap?

Contact your insurance supplier quickly. They might offer choices or direction on dealing with the monetary parts of your deductible.

Is a lower deductible in every case better for exhaustive coverage?

Not really. The right deductible for extensive coverage relies upon individual inclinations, risk resistance, and spending plan contemplations.

How frequently would it be a good idea for me to survey my auto insurance strategy?

It’s prudent to survey your arrangement every year or at whatever point critical life altering events happen, guaranteeing it lines up with your ongoing requirements and conditions.