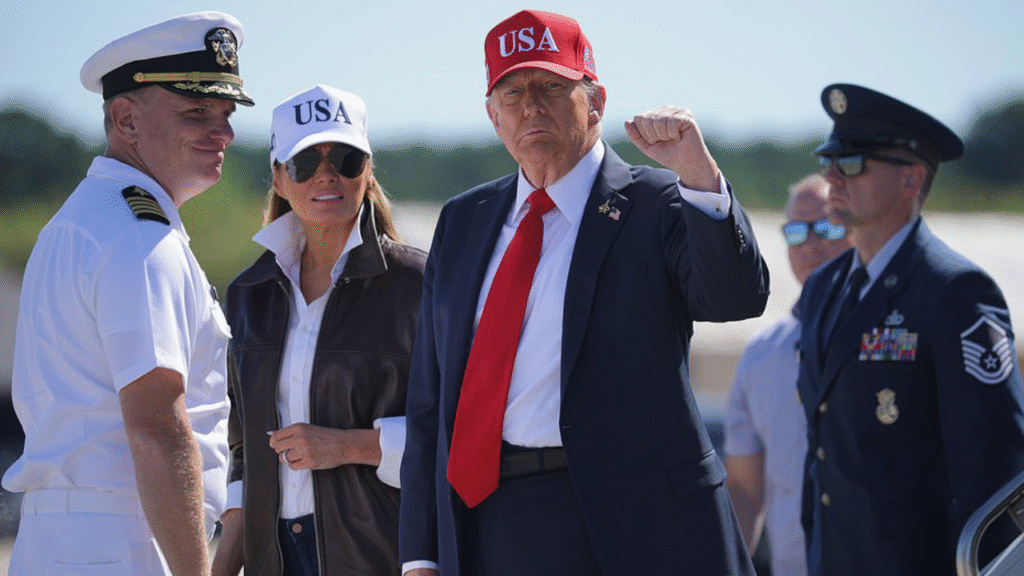

In a recent statement, President Donald Trump urged U.S. mortgage financing companies Fannie Mae and Freddie Mac to “get big homebuilders going,” emphasizing the country’s ongoing housing supply challenges. Trump highlighted that many builders are “sitting on 2 million empty lots,” signaling a potential opportunity to address the nation’s housing shortage. This initiative reflects the administration’s proactive efforts to boost construction and tackle the housing affordability crisis.

Understanding the Call to Action

What Are Fannie Mae and Freddie Mac?

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) are government-sponsored enterprises that play a critical role in the U.S. housing market. They purchase mortgages from lenders, providing liquidity and stability. Together, they guarantee a significant portion of U.S. mortgages, ensuring the housing market continues to function smoothly even during economic fluctuations.

The Housing Supply Issue

The U.S. faces a persistent housing supply gap. Estimates suggest that the shortage of available homes reaches millions nationwide, with some regions particularly affected. Even with recent increases in homebuilding, experts warn that it would take several years to close this gap at the current pace of construction. Shortages in the South and other high-demand areas are especially acute, making government intervention a potential solution to encourage builders to accelerate projects.

Trump’s Perspective on Homebuilders

President Trump has repeatedly expressed frustration with large homebuilders, comparing their control over construction output to monopolistic behavior in other industries. He argues that builders have the capacity to increase housing production but choose not to, which further exacerbates the shortage of homes. By calling on Fannie Mae and Freddie Mac to intervene, Trump aims to incentivize builders to start construction on the millions of empty lots they currently own.

The Role of Fannie Mae and Freddie Mac

Potential Strategies for Intervention

While the exact measures are yet to be defined, there are several ways Fannie Mae and Freddie Mac could stimulate homebuilding:

- Financing Support: Offering low-interest financing or specialized construction loans could reduce the financial burden on builders and encourage them to start new projects.

- Loan Guarantees: Providing guarantees for construction loans can mitigate risks for lenders, making them more willing to fund housing projects.

- Policy Adjustments: Relaxing certain underwriting standards or regulatory requirements for construction loans can facilitate faster project approvals.

Collaboration between Fannie Mae, Freddie Mac, lenders, and homebuilders is crucial for these strategies to succeed.

Challenges and Considerations

Builder Incentives

Even with government-backed incentives, builders face several challenges:

- Market Demand: Builders may hesitate to start new projects if there is uncertainty about the number of buyers or market stability.

- Construction Costs: Rising prices for materials and labor can discourage construction despite incentives.

- Regulatory Hurdles: Local zoning laws, permitting delays, and building codes can slow down or block new housing projects.

Impact on Housing Affordability

Boosting housing supply is only one part of the solution. New construction must also be affordable to truly address the housing crisis. If homes are priced out of reach for middle-income families, the increased supply may not alleviate the most pressing housing needs.

Real-Life Example: Lessons from the 2008 Housing Crisis

The 2008 financial crisis demonstrated the importance of government intervention in the housing sector. At that time, Fannie Mae and Freddie Mac faced significant challenges due to the collapse of the housing market. Government support helped stabilize these institutions and restore confidence in the mortgage market. This example highlights how strategic intervention can influence the construction and housing sectors during times of crisis.

Tips for Encouraging Homebuilders

- Incentivize with Low-Interest Loans: Financial support reduces risk and encourages construction.

- Streamline Permitting: Simplifying local regulations accelerates project timelines.

- Promote Affordable Housing Programs: Ensure new homes target middle-income families to address the housing gap effectively.

- Use Public-Private Partnerships: Collaboration between government agencies and private builders can maximize efficiency and output.

Conclusion

President Trump’s call for Fannie Mae and Freddie Mac to stimulate big homebuilders represents a strategic effort to tackle America’s housing supply challenges. While the initiative’s success will depend on collaboration and execution, it emphasizes the importance of public-private partnerships in solving complex issues. Increasing home construction can help bridge the housing gap, but ensuring affordability remains critical for creating long-term solutions for families across the country.

FAQs

1. What is the focus of Trump’s initiative?

Trump is urging Fannie Mae and Freddie Mac to help big homebuilders accelerate construction on millions of empty lots.

2. How do Fannie Mae and Freddie Mac influence homebuilding?

They provide mortgage liquidity, loan guarantees, and financing solutions that make homebuilding financially viable.

3. What challenges do builders face?

Builders face high construction costs, regulatory hurdles, and market demand uncertainties.

4. Will this initiative affect home affordability?

It can, but only if new construction includes affordable housing options for middle-income families.

5. How does this compare to past government interventions?

Similar to the 2008 housing crisis, government support can stabilize the housing market and encourage construction.