Unlocking Financial Wisdom: Navigating Car Insurance Deductibles

Introduction

In the maze of financial choices, one region that frequently confuses people is the domain of car insurance deductibles. Unlocking financial wisdom includes understanding what these deductibles capability and the mean for they have on your generally financial prosperity. Unlocking Financial Wisdom: Navigating Car Insurance Deductibles.

Understanding Car Insurance Deductibles

Definition and Reason

Car insurance deductibles address the sum you pay personal before your insurance kicks in. This fills in as a financial cradle, guaranteeing you share the weight of fix costs with your insurance supplier.

Sorts of Deductibles

There are various sorts of deductibles, like crash and far reaching. Each type has its subtleties, impacting the coverage and expenses.

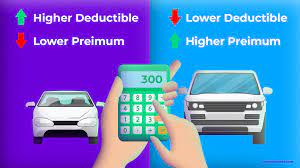

What Deductibles Mean for Charges

The connection among deductibles and expenses is significant. Settling on a higher deductible can bring down your premium, yet it accompanies expanded personal costs during a case.

Assessing What is going on

Surveying Spending plan Requirements

Prior to plunging into deductible choices, assess your spending plan requirements. Think about your month to month income and decide a deductible that lines up with your financial limit.

Backup stash Contemplations

Assembling and keeping a secret stash is crucial. Sufficient investment funds can assist you with easily overseeing higher deductibles without risking your financial security.

Picking the Right Deductible

Adjusting Charges and Deductibles

Tracking down the right harmony among charges and deductibles is a craftsmanship. Investigate your gamble resilience and gauge the expected reserve funds against the gamble of higher personal costs.

Influence on Personal Costs

Understanding the potential personal costs is fundamental. A shrewd deductible decision guarantees you’re ready for unanticipated conditions without burning through every last dollar.

Perplexity in Deductible Choice

Normal Misguided judgments

A few misguided judgments encompass car insurance deductibles. Exposing these legends is significant for pursuing informed choices that line up with your financial objectives.

Elements to Consider

Consider factors like the worth of your vehicle, driving propensities, and the recurrence of cases. These components assume a fundamental part in deciding the ideal deductible for your circumstance.

Burstiness in Financial Preparation

Adjusting to Life Changes

Life is dynamic, and so ought to be your deductible decisions. Embrace burstiness in your financial preparation by reevaluating deductibles during significant life altering events, like purchasing another car or moving.

Reconsidering Deductibles Occasionally

Occasionally reconsidering your deductibles guarantees they stay lined up with your advancing financial circumstance. What seemed OK a couple of years prior may not be ideal today.

Genuine Situations

Instances of Savvy Deductible Decisions

Investigate genuine situations where people settled on astute deductible decisions, delineating the positive effect on their financial prosperity.

Results of Unfortunate Decisions

On the other hand, dig into useful examples where unfortunate deductible choices brought about financial strain. Gaining from others’ encounters is a significant part of financial schooling.

Navigating Strategy Subtleties

Fine Print Mindfulness

Understanding the fine print in your insurance strategy is critical. Know about any subtleties connected with deductibles, coverage cutoff points, and possible escape clauses.

Looking for Proficient Guidance

If all else fails, look for proficient guidance. Insurance specialists can give bits of knowledge custom fitted to your interesting conditions, assisting you with pursuing informed choices.

Drawing in the Peruser: What’s Your Deductible intelligence level?

Intelligent Test

Test your deductible information with our intelligent test. Survey your understanding of deductibles and gain important experiences into your financial navigation.

Understanding Outcomes

Investigate the right responses and clarifications for a thorough understanding of car insurance deductibles. Utilize this information to adjust your deductible decisions.

Advantages of Insightful Deductible Decisions

Long haul Financial Security

Pursuing savvy deductible decisions adds to long haul financial dependability. It’s a proactive move toward protecting your financial future.

Stress Decrease in Crises

In crises, the last thing you really want is financial pressure. Ideal deductible decisions give genuine serenity, permitting you to zero in on settling what is happening within reach.

Normal Entanglements to Keep away from

Overcommitting to Deductibles

Stay away from the trap of overcommitting to high deductibles. While it might bring down expenses, it could prompt financial strain assuming an unforeseen occasion happens.

Overlooking Strategy Updates

Insurance arrangements advance. Disregarding updates can leave you with obsolete coverage. Remain informed about changes in deductibles and coverage to make opportune changes.

Dynamic Voice in Navigation

Assuming Command over Your Funds

Play a functioning job in your financial choices. Car insurance deductibles are inside your control, and savvy decisions enable you to explore the intricacies of the insurance landscape unhesitatingly.

Proactive Deductible Administration

Try not to trust that issues will emerge; be proactive in dealing with your deductibles. Consistently survey and change them on a case by case basis, lining up with your ongoing financial objectives and conditions.

Relationships for Lucidity

Deductibles as Financial Guardrails

Consider deductibles financial guardrails, directing you through startling financial turns. They keep you from going astray during testing times.

Picking Deductibles Like an Expert

Choosing deductibles is likened to a gifted driver picking the right stuff for the street ahead. It requires premonition, thought, and a sharp understanding of the territory.

Conclusion

In the mind boggling universe of individual accounting, unlocking financial wisdom includes becoming amazing at navigating car insurance deductibles. By understanding the subtleties, assessing what is happening, and settling on informed decisions, you make a proactive stride towards financial security.

FAQs

Could I at any point change my car insurance deductible subsequent to buying a strategy?

Indeed, numerous insurance suppliers permit policyholders to change deductibles during the approach term.

How would I decide the right deductible for my circumstance?

Consider factors like your financial plan, risk resilience, and the worth of your vehicle. A harmony among charges and potential personal costs is critical.

Are higher deductibles in every case better for bringing down charges?

Not really. While higher deductibles can bring down charges, they likewise increment your personal costs during a case.