Deciphering Auto Insurance Deductibles: A Complete Guide

Introduction

Understanding auto insurance deductibles is fundamental for each vehicle proprietor. These deductibles assume a vital part in the monetary parts of insurance coverage, impacting charges and guarantee repayments. In this exhaustive aide, we’ll explore through the complexities of auto insurance deductibles, revealing insight into the sorts, influence on expenses, and techniques for settling on informed choices. Deciphering Auto Insurance Deductibles: A Complete Guide

Sorts of Auto Insurance Deductibles

With regards to auto insurance, different deductible sorts exist. Crash deductibles cover harms coming about because of mishaps, while complete deductibles handle non-impact occurrences like robbery or cataclysmic events. Uninsured/underinsured driver deductibles become an integral factor when the to blame party isn’t enough guaranteed, and clinical installments deductibles cover medical services costs. Understanding these sorts is significant for fitting your insurance to your particular requirements.

What Deductibles Mean for Charges

The connection among deductibles and expenses is an indispensable component impacting insurance costs. By investigating this dynamic, you can settle on informed choices that line up with your financial plan and coverage necessities. Picking the right deductible isn’t just about limiting costs; about finding the equilibrium suits what is happening.

Translating Deductible Sums

Auto insurance deductibles can be fixed dollar sums or rate based. Each has its advantages and disadvantages, and interpreting the perfect sum requires understanding your monetary capacities and hazard resistance. This segment separates the distinctions, assisting you with settling on choices that line up with your exceptional conditions.

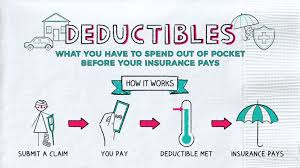

Making a Case with Deductibles

Understanding how deductibles become an integral factor while making a case is fundamental for a smooth settlement process. We’ll direct you through the case interaction, featuring the job of deductibles and offering tips to smooth out your experience.

Factors Affecting Deductible Determination

Picking the right deductible includes thinking about different elements, like monetary strength, risk resistance, and vehicle utilization. By analyzing these components, you can pursue choices that give sufficient coverage without burning through every last cent.

Normal Confusions About Deductibles

There are various legends and misunderstandings encompassing auto insurance deductibles. This part disperses normal misinterpretations, guaranteeing you have precise data while settling on conclusions about your coverage.

Procedures for Overseeing Deductibles

Overseeing deductibles includes something other than choosing a number. Packaging insurance approaches, taking on wellbeing measures, and intermittent surveys of your decisions are methodologies that can upgrade your general insurance experience.

Deductibles and Various Sorts of Coverage

Different coverage types accompany their own arrangement of deductibles. Understanding how deductibles apply to responsibility and far reaching coverage guarantees an extensive understanding of your strategy.

Perplexity in Deductible Choice

The choice among low and high deductibles can confuse. This part tends to the disarray, giving bits of knowledge into tracking down the right equilibrium that suits your remarkable conditions.

Burstiness in Auto Insurance Deductibles

Startling occasions can influence your deductibles. Figure out how burstiness assumes a part in changing deductibles in view of life changes and flighty episodes.

Contextual analyses

Genuine models grandstand the effect of deductible choices. By investigating these cases, you can gather important illustrations and apply them to your own insurance decisions.

Future Trends in Auto Insurance Deductibles

As innovation propels, so do trends in auto insurance deductibles. Remain informed about the advancing landscape, including how buyer inclinations and mechanical advancements might shape the future of deductibles.

Conclusion

In conclusion, translating auto insurance deductibles is a pivotal part of dependable vehicle proprietorship. By understanding the sorts, influence on expenses, and procedures for pursuing informed choices, you enable yourself to explore the complicated universe of auto insurance with certainty.

FAQs

Q: Might I at any point change my deductible in the wake of buying insurance?

A: Indeed, generally speaking, you can change your deductible during strategy restorations.

Q: How does my deductible influence my month to month charges?

A: By and large, higher deductibles lead to bring down month to month charges, as well as the other way around.

Q: Are there deductible choices for obligation coverage?

A: Deductibles commonly apply to actual harm coverage, not risk.

Q: What is the reason for a rate based deductible?

A: Rate based deductibles are determined as a level of the complete case sum.

Q: Do deductibles shift in view of the sort of vehicle I own?

A: Indeed, the sort and worth of your vehicle can impact the suggested deductible sum.