Car Insurance Deductibles and How They Work

Introduction:

Vehicle insurance is a significant part of capable vehicle proprietorship, giving monetary security in case of mishaps or unexpected conditions. One vital component of vehicle insurance that frequently befuddles policyholders is the deductible. In this article, we’ll unwind the secret behind vehicle insurance deductibles and investigate how they work. Car Insurance Deductibles and How They Work

What is a Vehicle Insurance Deductible?

A vehicle insurance deductible is the sum you consent to pay personal before your insurance inclusion kicks in. It goes about as your monetary commitment to a case, and the safety net provider takes care of the leftover expenses. There are various kinds of deductibles, including fixed, rate based, and vanishing deductibles. Car Insurance Deductibles and How They Work

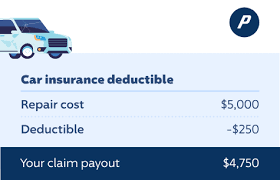

How Do Vehicle Insurance Deductibles Function?

Understanding how deductibles work is critical for exploring the cases cycle. Envision you have a $500 deductible, and you’re engaged with a mishap coming about in $2,000 worth of harm. In this situation, you would pay the $500 deductible, and your insurance organization would cover the leftover $1,500.

Picking the Right Deductible for You:

Choosing the right deductible includes considering factors like your spending plan, risk resilience, and driving propensities. While a higher deductible can bring down your premiums, it likewise implies a higher personal expense in case of a case. On the other hand, a lower deductible outcomes in higher premiums however lower prompt expenses while recording a case.

Influence on Premiums:

The connection among deductibles and premiums is a fragile equilibrium. Changing your deductible can impact your insurance costs. We’ll dive into systems for overseeing premiums successfully without compromising inclusion.

Common Misconceptions:

Numerous misconceptions encompass vehicle insurance deductibles, prompting disarray among policyholders. We’ll expose normal fantasies and give lucidity on how deductibles really work.

Ways to oversee Deductibles Successfully:

Exploring the universe of deductibles requires some skill. We’ll give functional tips to overseeing deductibles successfully, guaranteeing you pursue informed choices.

Deductibles and Inclusion Cutoff points:

Understanding how deductibles connect with inclusion limits is fundamental for exhaustive insurance arranging. We’ll investigate the subtleties and ramifications of deductible decisions on inclusion choices.

Claims Cycle with Deductibles:

Documenting a case includes explicit advances, and deductibles assume a urgent part in this cycle. We’ll direct you through the cases cycle and deal experiences into normal difficulties and their answers.

Effect of Deductibles on Various Kinds of Inclusion:

Various sorts of inclusion accompany differing deductible designs. We’ll investigate how deductibles apply to thorough and impact inclusion, assisting you with fitting your insurance to your requirements.

Evolving Deductibles: When and How:

Life conditions might provoke an adjustment of deductibles. We’ll examine the elements that could prompt changing your deductible sums and the cycle engaged with rolling out such improvements.

Deductibles and Mishap Absolution Projects:

Mishap absolution programs are turning out to be more normal. We’ll investigate how deductibles meet with these projects and gauge the advantages and downsides of taking an interest.

Contrasting Deductibles Across Guarantors:

While looking for insurance, understanding how deductibles contrast among guarantors is significant. We’ll give tips to successfully contrasting deductibles and going with informed decisions.

Legitimate Ramifications of Deductibles:

Past monetary contemplations, there are legitimate viewpoints to deductibles. We’ll give an outline of the legitimate ramifications, guaranteeing you stay agreeable with state regulations and guidelines.

Conclusion:

In conclusion, vehicle insurance deductibles are a crucial part of your insurance strategy that requires cautious thought. By understanding how deductibles work and pursuing informed decisions, you can find some kind of harmony among inclusion and cost.

FAQs:

Might I at any point change my deductible whenever?

While you can for the most part change your deductible, there might be limitations. Check with your guarantor for explicit subtleties.

Do a wide range of inclusion have deductibles?

Actually no, not all inclusion types have deductibles. Responsibility insurance regularly doesn’t include deductibles.

What occurs on the off chance that I can’t bear the cost of my deductible after a mishap?

A few guarantors offer installment plans or funding choices. Contact your back up plan to talk about likely arrangements.

Are deductible sums normalized across safety net providers?

No, deductible sums can shift essentially among back up plans. It’s vital for analyze choices while looking for insurance.

Will my deductible be postponed under particular conditions?

A few strategies offer deductible waivers for explicit circumstances, for example, glass fixes. Survey your arrangement for subtleties.